Jun Wakabayashi, Analyst (若林純 / 分析師)

Jun is an Analyst covering both AppWorks Accelerator and Greater Southeast Asia. Born and bred in America, Jun brings a wealth of international experience to AppWorks. He spent the last several years before joining AppWorks working for Focus Reports, where he conducted sector-based market research and interviewed high-level government leaders and industry executives across the globe. He’s now lived in 7 countries outside US and Taiwan, while traveling to upwards of 50 for leisure, collectively highlighting his unique propensity for cross-cultural immersion and international business. Jun received his Bachelors in Finance from New York University’s Stern School of Business.

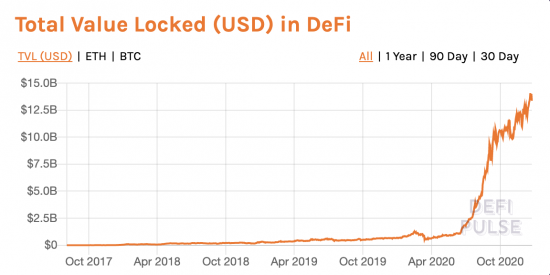

It’s been one heck of a year, for blockchain especially. The industry hasn’t seen this much excitement since the ICO fervor of 2017. In March 2020, crypto prices saw a significant crash as the global economy entered into lockdown due to COVID-19. Fast forward to the year-end, BTC has reached an all-time high of US$33K on the back of increasing interest from major institutional investors. Meanwhile, decentralized finance (DeFi) has very quickly captured everyone’s mindshare, now with over $18B of total value locked into an ever expanding list of decentralized platforms such as Compound and Uniswap.

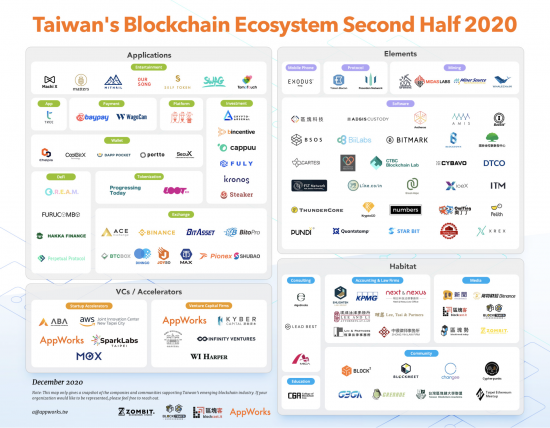

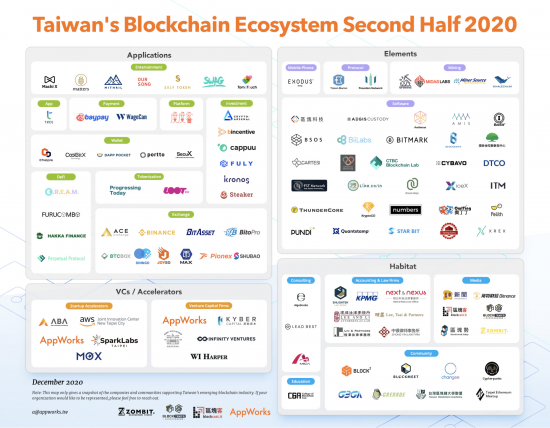

They say heroes are often born in a crisis. Well, despite the pandemic, this past half year saw 14 new companies added to Taiwan’s blockchain ecosystem map, indicative of three primary trends currently driving the industry forward.

1. Proliferation of DeFi

The concept of DeFi may be relatively unknown to outsiders prior to 2020, in the same way that BTC was prior to 2017. That’s because it was really only this year that DeFi was thrusted into the limelight. Decentralized lending protocol Compound was arguably the frontrunner of the DeFi craze. Launched in 2018, the platform enables users to collateralize cryptocurrencies and earn interest, while also allowing them to borrow other cryptoassets against the collateral. Algorithms are used to automatically adjust interest rates based on supply and demand, while smart contracts eliminate the traditional need for an intermediary such as a bank.

Compound was certainly novel in and of itself, but what really helped jumpstart adoption was in June 2020 when it started distributing its native governance token COMP to all lenders and borrowers on the platform. Similar to shareholders of a publicly listed company, token holders are entitled to vote on any changes to the protocol, or sell their tokens on the secondary market for extra returns on top of the interest earned from lending.

The free reward was enough to attract hordes of early users eager to park their crypto in hopes of maximizing yield, otherwise known as “liquidity mining,” allowing Compound to briefly overtake Maker as the leading DeFi project in terms of total value locked-in (TVL). It wasn’t long before the rest of the industry started rolling out liquidity incentives of their own. Decentralized exchanges Balancer and Uniswap each announced distribution of their respective governance tokens to users within months of each other. Both serve as automated market makers that create liquidity pools for users to seamlessly buy and sell tokens, albeit in slightly different fashions.

Similarly, in Taiwan, we saw the launch of Black Hole Swap, developed by AW#21 alumni Hakka Finance, and C.R.E.A.M Finance, started by the founder of both Mithril and M17 (AppWorks is an investor) Jeffrey Huang. C.R.E.A.M repackages the best functionalities of Compound, Uniswap, and Balancer all into one platform, and is now among the top 5 decentralized lending platforms in terms of TVL according to DeFi Pulse.

The DeFi space is relentless. Hacks, forks, “vampire attacks”—it seems like the moment any one project finds some modicum of success, there will be a handful others lurking in the shadows, ready to replicate, iterate, or outright steal the idea right out from under. But it’s still early days for DeFi, and one can argue that this type of competition is natural for such a nascent industry. The hackers, arbitrageurs, speculators, and bad actors will stress test the technology and incentive schemes and fully push them to the limits. Ultimately, only the fittest, the most resilient and practical will be left standing, collectively strengthening the ecosystem as a whole.

2. NFTs on the rise

Following DeFi, non-fungible tokens (NFTs) have continued rising in popularity globally. Gaming and artwork collectibles serve as the primary use cases so far, no doubt perpetuated by decentralized marketplaces such as Rarible, SuperRare, and Async. There are now fully virtual worlds like Decentraland dedicated to showcasing NFTs. In the offline world, famed auction house Christies recently sold their very first NFT artwork for over US$130,000 back in October 2020.

The jetsetters of digital collectibles, Dapper Labs (the team behind CryptoKitties, AppWorks is an investor) officially launched NBA Top Shot in mid-2020, with revenues reaching US$2 million by year end. The NFT-powered marketplace allows users to buy and sell “digital moments” captured from NBA games. These moments are then stored on the Flow blockchain, an entertainment-focused protocol developed by Dapper Labs which recently raised US$18 million in a token sale.

In Taiwan, AW#20 alumni Lootex has been a long-time believer of NFTs, creating a decentralized auction house for people to create, buy, or sell cryptoitems. They just recently partnered with startup Eternalink and Spanish winery NEKEAS to create NFTs every time a bottle of the limited edition Eternalove red wine is sold. Meanwhile, Alex Liu, the founder and CEO of Taiwan’s largest crypto exchange MAX mentioned in a recent interview that NFT serves as a critical bridge between the virtual and physical worlds and will be the focus of their development efforts in the coming years.

Riding off the excitement of DeFi, NFTs are clearly growing in prominence, with weekly trading volume nearing US$2.5 million in December, up severalfold from a couple months prior. While collectibles and entertainment have occupied the spotlight, NFTs and their verifiable proof of authenticity have the potential to extend into many other areas including real estate, supply chain, identity verification, and copyright management, and yes, even crossovers into DeFi. Compared to DeFi, however, where Taiwanese startups have gained global recognition, NFTs have received much less interest in Taiwan; but, certainly there’s much more room to play and momentum is already visibly picking up.

3. Crypto goes mainstream

Although beginning with a rather sluggish start, 2020 was most certainly a win for crypto bulls. Increasing interest and support from major institutions like Square, MicroStrategy, MassMutual, Visa, and PayPal collectively served as a monumental endorsement, helping to push the price of BTC far past its 2017 levels and into a record high of US$33K at the time of writing. Evidently, COVID-19 was a large driver in accelerating digital adoption, boosting confidence in cryptocurrencies like BTC as a safe and reliable store of value. Many countries from China to the US are now exploring the creation of their own central bank digital currencies (CBDC), perhaps in direct response to Facebook’s Libra project, which has since been renamed to Diem to signal its independence and distance itself from the social media giant.

When it comes to crypto investment, although much work has been done under the hood to reduce friction and improve the overall user experience, widespread skepticism and caution is still common among the average retail investor due to the volatility and complexity of the market.

In the second half of the year, we saw several Taiwanese startups working on innovative ways to reduce the entry barriers for new investors. Targeting newcomers with zero crypto investing experience, Cappuu (AW#17) is an easy-to-use crypto wallet that allows users to purchase stablecoins with credit cards and invest in high-yield DeFi products without any gas fees. Recently closing a US$1 million seed round, Steaker (AW#20) is a crypto asset management platform that presents several different predetermined investment strategies based on users’ risk appetite and return profile. Fuly.AI (AW#20) helps investors automate their portfolio allocation and interest collection on crypto exchanges like Bitfinex to maximize returns.

The pace at which blockchain has been evolving is truly astounding, and the pandemic has likely only turbocharged the development. Given its more conservative nature, Taiwan has traditionally lagged behind the latest and greatest in software innovations. But if its success with DeFi this past year is any indication, Taiwan punches well above its weight when it comes to blockchain, so far matching industry trends stride for stride. If Taiwanese entrepreneurs can continue evolving and iterating alongside the speed of crypto, they will be well positioned to define the next wave of blockchain projects moving into 2021, whether that’s in DeFi, NFT, or otherwise.

Taiwan’s Blockchain Ecosystem Map Second Half 2020 is jointly produced by AppWorks, Blockcast (AW#14), BlockTempo (AW#16), and Zombit (AW#21). It is updated every six months. If you have any feedback and suggestions, please email [email protected].

【If you are a founder working on a startup in SEA, or working with AI / IoT, Blockchain / DeFi, apply to AppWorks Accelerator to join the largest founder community in Greater Southeast Asia.】