AppWorks Demo Day #30 與Wistron Demo Day #8 今日聯手盛大舉行,來自印尼、新加坡、台灣、日本、韓國等國的24組新創團隊輪番登台發表,不論是曾被視為小眾領域的太空科技、Web3 ,或是已成顯學的AI,都可在場看到大東南亞新創的優異發展。AppWorks Accelerator今年邁入成立第15年,作為亞洲早期網路與科技創投的先行者,其校友生態已邁向成熟,更是展現規模。AppWorks #30(AW#30)團隊中,有高達33%為連續創業者,更有18%的新創已達成年營收破百萬美元的里程碑,顯示出本屆創業者的強韌實力與商業落地能力。

深科技飛入太空!太空邊緣生成式AI實現微型衛星即時影像辨識、應對災害國防任務

來自新加坡的Aliena成立於南洋理工大學,專攻鞋盒大小的微型衛星所使用的MUSIC微型霍爾效應推進器,該系統可用於近地軌道(LEO)以及超低地球軌道(VLEO)軌道部署,功耗低、體積小、即插即用,它已成功搭載多顆衛星執行高解析度影像擷取、氣候監測和通訊調整任務,協助衛星「移動」和「調整」任務。 Aliena公司已籌集總計930萬美元的資金,並於2025年初在新加坡開設了一個佔地8000平方英尺的製造和測試中心,如同亞洲版的星鏈(Starlink),推動該地區乃至全球航太產業的進一步商業化和普及化。

精準解決室內導航痛點!以AI地圖系統打造無需GPS的城市級室內定位新標準

Mapxus是一家快速成長的室內地圖技術平台,提供全球應用的先進室內地圖服務。其室內可視化系統(AI Indoor GeoSpatial Platform)結合了通用多感測、定位和人工智慧技術,建立了前所未有的三層室內地圖,包括數位地圖、室內定位和360度全景視覺地圖。憑藉著香港港鐵、日本成田機場、川崎重工、三井集團等多家知名企業客戶與多項獎項背書,Mapxus已邁入亞太主要市場,也成功在台北車站試運行試運行無藍芽室內導航,且積極延伸智慧醫療、學校、政府等多項應用,未來技術與市場潛力持續擴張,是國際室內定位導航領域的重要創新者,大大提升消防等室內意外的公共安全層級。

從去中心化借貸到衍生品交易,區塊鏈與Web3開啟金融新邊界

Yei Finance是 Sei (Sei Network, Layer 1 公鏈) 生態中規模最大、成長最快的去中心化借貸協議,具備成為主流 DeFi 核心基礎設施的實力,總鎖倉價值 (Total Value Locked,TVL) 已突破 1.4 億美元,並由美國知名的 Web3 風投公司 Manifold 領投 200 萬美元的種子輪融資。平台建構於高效能的 Sei 區塊鏈,支援存款生息、抵押借貸與閃電貸,結合 Circle CCTP 技術實現多資產跨鏈轉移。自推出以來已吸引近20萬名用戶,累積流入資金高達 7.6 億美元,月營收逼近 70 萬美元,並已和 Binance Wallet、OKX Wallet 等建立策略合作,持續朝成為 DeFi 核心金融基礎設施邁進。

來自美國的Web3團隊Omo AI Labs推出旗艦產品Neko,這是一款專為區塊鏈衍生品交易平台 Hyperliquid生態系打造的DeFi App。其創辦人是巴基斯坦移民第二代,成長於醫生世家,父母皆為從醫者,他卻選擇不走傳統路線,毅然成為家族中的「黑羊」,自學投入Web3領域。Neko不僅整合協議資金庫(Protocol Vault)中Neko Earn收益管理基礎設施,並導入AI自主執行交易與任務,優化使用者的操作效率與決策品質。目前Neko已在Hyperliquid社群中獲取自然擴散與用戶的高度接受,並與HyperEVM開發者緊密合作,商業模式涵蓋多元收益來源,包括:現貨與永續合約手續費、收益管理抽成,以及未來規劃的代理服務商品化收入,是金融衍生商品前沿競爭的新疆界。

從本土電視劇到入選國際影展,台灣原創IP數位轉譯能力打通全球,展現強韌競爭潛力

隨著亞洲影視產業蓬勃發展,來自台灣的創新娛樂科技團隊Toii正在打造一條從影視IP到XR沉浸式互動娛樂的新型價值鏈。作為一款結合XR技術、即時影像辨識與地點導向設計的遊戲化平台,Toii 專注於將知名電視劇與電影轉化為可玩、可參與的互動內容,包括為「台灣霹靂火」、「女鬼橋」、「都市傳說冒險團2 – 分身」等台灣原生影視內容提供全新的商業延伸與國際化想像。Toii平台不僅支援地點式實境互動與真人演出,讓觀眾以玩家身份重返熟悉的劇情場景,也成功推動多部影視改編遊戲登上排行榜冠軍,包含收視率冠軍電視劇與人氣院線電影。Toii更獲選2025年Nvidia Inception Program、2024年日本 XR Golden Award 等多項國際肯定,展現其技術與創意實力。目前Toii正積極與全球內容持有者、影視製作方與出版商合作,提供專案型聯合開發,也開放策略投資與資本合作機會,致力於打造一個以亞洲為起點、面向全球的IP沉浸式娛樂平台。對於台灣原創影視與遊戲產業而言,Toii的模式提供了一種可商業化、可規模化的出口路徑,有望成為新一波文化科技融合的標竿案例。

時尚AI設計工具攜手台灣供應鏈,打造設計到量產的一站式時尚創新平台

台港混血的革命性的時尚設計工具NarrativeAI,致力於解決時尚產業中普遍存在的設計與生產流程瓶頸,全面加速從構想到量產的執行效率。這款平台透過生成式AI技術,能將手繪草圖、文字敘述等創意構想快速轉換為符合生產需求的技術規格文件(Techpack),大幅縮短設計與製造之間的斷層。NarrativeAI更整合全球供應商資料庫與時尚趨勢分析模組,協助設計師預判全球流行動向、即時比對素材與製造選項,成為設計師創作力與精準度的放大器,並與包含Lululemon、Nike等台灣在內的亞洲關鍵供應鏈夥伴展開深度試點合作,預計將於今年底釋出公開Beta 版,並擴展至鞋履、配件與運動服等多品類應用,打造設計師真正的一站式創作與製造平台。

緯創與AppWorks聯手邁入第8屆,深度應用AI推動產業級Deep Tech商用落地

同一天登場的緯創加速器(Wistron Accelerator)則推出5家深科技新創團隊,正運用AI技術重塑各產業的生產效率與營運模式。Barn Owl Technologies推出AI + IoT即時害蟲監測系統,協助農民減少化學使用、提升作物產量;BRICKS則打造無需編碼的互動式數位看板平台,讓餐飲業者能快速部署AI優化的動態點餐介面,提高客單銷售利潤。專注於數據洞察的LargitData提供AI輿情分析與企業智慧決策支援,幫助企業掌握市場趨勢、化解公關風險。軌道科技新創POD Innovation將AI融入先進駕駛輔助系統(ADAS),運用感測器融合與數位孿生模擬,為鐵路營運建立更安全的防線。 來自新加坡的Niyam AI,則以其專為EMS電子製造服務業打造的平台,提供即時設計驗證與風險評估,加速產品開發流程、減少出貨延遲,成為智慧製造升級的重要引擎。

校友帶動產值破163億美元!累積募資總額達66億美元,引領創新經濟穩步登峰

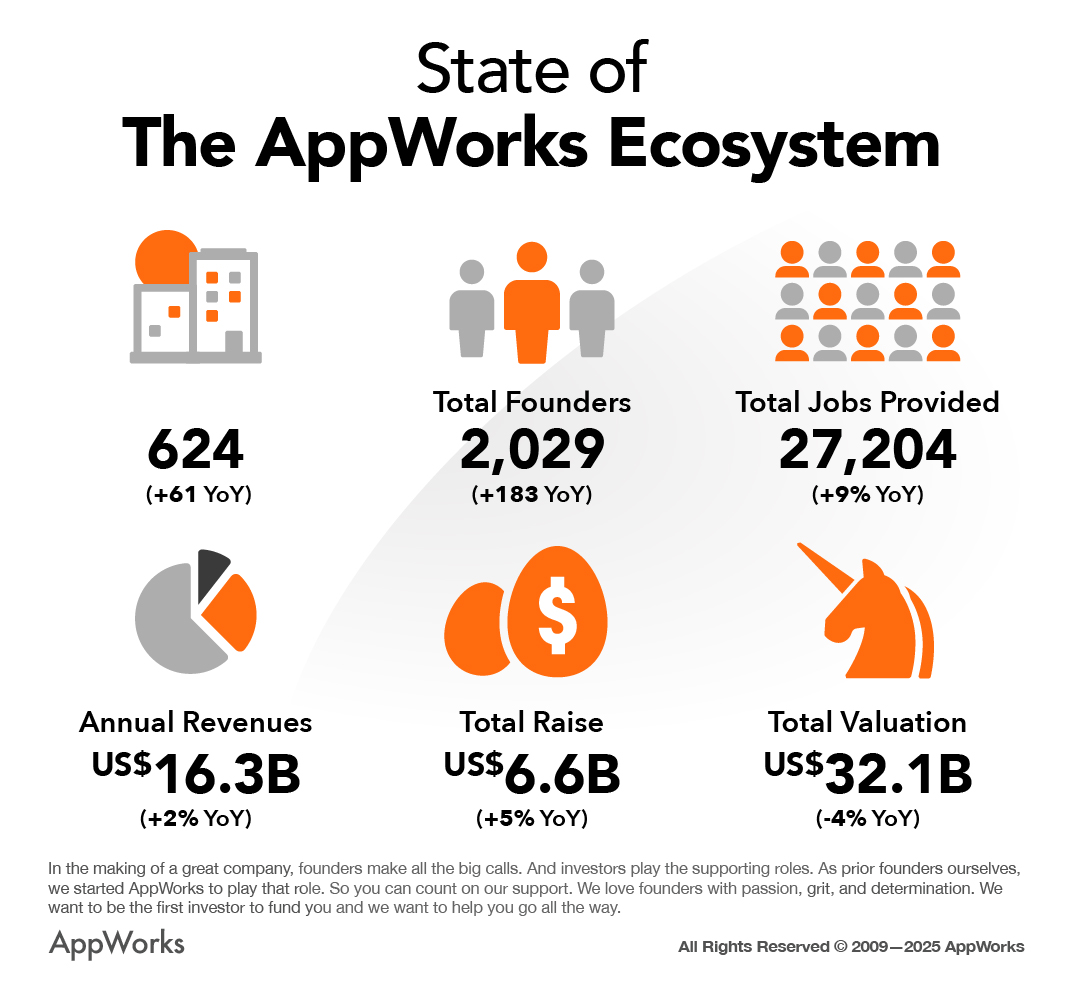

成立15年以來,從 AppWorks Accelerator畢業的活躍新創已達624家、共計2,029位創業者。AppWorks生態系所有新創加總營業額達163億美元,年增2%;創造27,204個工作機會,年增9%;累積募資金額66億美元,年增5%;總市值達321億美元。本屆Demo Day更有 18% 團隊達年營收100萬美元以上,33% 為連續創業者,區域創業生態邁向成熟階段。

回顧15年歷程,AppWorks董事長暨合夥人林之晨感性地指出:「這是AppWorks第30次舉辦Demo Day,也是專為AppWorks#30團隊搭建、讓他們可以與優質投資人、企業合作夥伴認識,促成後續合作的舞台。15年前,AppWorks Accelerator在金融海嘯後的創業沙漠中啓動,一開始沒人看好,但半年後的AppWorks Demo Day #1,卻能吸引來超過200位投資人與企業代表出席,後續許多AppWorks #1新創也因此獲得資本、商務合作,甚至連我自己,也在出席貴賓中找到今日的合夥人程九如。Demo Day #1的成功給了我們很大信心,過去15年來一屆一屆加速器持續推進、也一次一次Demo Day持續舉辦。沒有奇蹟只有累積,如今AppWorks校友已高達624家活躍新創,全體加總年營業額近4,800億新台幣,而我們也在過程中持續貢獻台灣新創生態,讓當年的沙漠,今日長出茂盛的雨林。本次登場的AW#30團隊,在各自領域都已有優異成績,值得投資人、企業夥伴關注合作,相信這些合作,在未來會產生巨大的效益。」

關於 AppWorks 之初加速器集團

2009 年成立,由「創業者」為「創業者」設立的加速器,以及基於加速器發展的新創社群與創投機構,致力在大東南亞地區協助下世代的創業者,抓住數位革命的成長機會。正如同 Mobile Internet 帶來了巨變,我們相信 ABS – AI、Blockchain 與 Southeast Asia 是今日的三大典範轉移。我們認為,創造一個偉大事業的過程中,團隊是主角,而投資人則是配角,我們專注扮演配角,從種子時期開始支持有想法的團隊,一路陪著他們打造區域級、世界級的偉大企業。AppWorks 目前共提供 Accelerator、Funds 與 School 等三項主要服務。

更多資訊:appworks.tw

關於 AppWorks Accelerator 之初加速器

2010 年成立,每半年嚴選本區域最具潛力的新創團隊進駐。輔導新創團隊尋找 Product-Market Fit、幫助成長期團隊建立 Sustainable / Scalable Business Models。成立以來,從 AppWorks Accelerator 畢業的活躍新創已達 624 家、2,029 位創業者。AppWorks 生態系所有新創加總營業額達 163 億美元,年增 2%;提供就業數 27,204 位,年增 9%;累積募資金額 66 億美元,年增 5%;總市值 321 億美元。其中,AppWorks 生態系已有 146 家活躍新創來自 Web3 領域、128 家致力於 AI 相關發展,以及 195 家主力發展市場位於東南亞,共計分佈於台灣、印尼、新加坡、馬來西亞、越南、菲律賓與香港等七大市場。

關於 AppWorks Funds 之初創投基金

AppWorks 管理四支創投基金總共募集 3.5 億美元,我們與認同 AppWorks 理念的投資人合作,其中包括在科技製造、金融、媒體、電信等領域領先的企業。我們通常投資種子輪至 C 輪的新創,每年進行 20-30 個投資案,目前為止已投資超過 100 家新創,其中許多在其所處產業或領域中居於領先地位,如:Lalamove、Dapper Labs / Flow、Animoca Brands、91APP、Figment、Carousell、ShopBack、17LIVE、KKday 等。此外,AppWorks Funds 至今已有 6 個 IPO 案 (Uber、隆中網絡、創業家兄弟、松果購物、91APP、17 Live)、6 個 IEO 案,以及 1 隻百角獸 (Hectocorn)、2 隻十角獸 (Decacorn) 與 5 隻獨角獸 (Unicorn) 。

關於 Aiworks by AppWorks School 之初學校

AppWorks School 成立於 2016 年,致力協助渴望投身數位、網路與電商產業的人才,提供高度銜接業界,實作導向、高效的紮實培訓計畫。成立至今,已培訓超過 1000 位學員,協助多間企業包含台灣大哥大、momo、91APP、KKday、WeMo Scooter 與 KKBOX 等知名新創與科技公司培訓數位人才。現提供軟體培訓營、校園培訓計畫、在職進修、企業代訓等服務。

2024 年轉型啟動Aiworks,旨在通過賦能企業員工,來幫助企業加速 AI 轉型。通過提供 AI 自動化課程,提升人才技能,使其能採用 AI 驅動自動化工作流程,顯著提高工作效率並節省成本。

更多資訊:school.appworks.tw

For general inquiries

Email: [email protected]

AppWorks 活動聯絡人(含發稿後媒體聯繫): HsiChun Tsai | +886-910-288-244 | mailto: hsichun@appworks.tw

AppWorks Demo Day #30 + Wistron Accelerator #8 團隊一覽 (依字母順序排列)

| AppWorks #30 | 中文簡介 | HQ |

| Aliena | 新世代微型衛星的驅動引擎 | SG |

| CarNow | 中古車金融整合平台,協助經銷商安全且規模化取得資金 | VN |

| CocoMart | 餐廳專屬食材採購平台,簡化 F&B 供應流程 | TW |

| DIVEROUT Tech | 潛水活動一站式平台,整合裝備、教練與行程預約 | TW |

| Eazy Digital | 保險科技 SaaS 平台,為保經通路提供 CRM 與數位投保工具 | TH |

| JALA | 為蝦農提供數據養殖與融資方案,提升養殖效率與資金取得 | ID |

| Mapxus | 室內地圖與空間智慧平台,支援快速建模與導航 | HK |

| Merito | 深科技專屬投資銀行,協助技術團隊媒合資本與策略夥伴 | JP |

| Mezink | AI 工具 SaaS,幫助社群創作者與品牌提升轉單效率 | IN |

| Munshot | AI 研究助理平台,協助金融機構自動化投資研究流程 | IN |

| Narrative.ai | 為時尚設計師打造 AI 協作平台,連接供應鏈與靈感創作 | HK |

| Omo AI Labs | 多代理人協作協議層,提供 AI agent orchestration 能力 | SG |

| Peris.ai | 結合 AI 的資安自動化平台,打造資安版 Zapier | ID |

| QuickGen AI | 行銷素材一鍵產生工具,加速早期品牌成長 | TW |

| Replyr | 利用 AI 將 WhatsApp 轉回即時客服工具 | MY |

| Sentiment | 全球首個情緒記憶金庫平台,結合 NFT 儲存個人記憶 | KR |

| Toii Games | 結合 XR 與定位技術,打造沉浸式的遊戲體驗 | TW |

| TopSchool.ai | AI 輔助學習平台,提升中小學教學效率與學習成效 | SG |

| Yei Finance | 跨鏈流動性與借貸基礎設施,支援多鏈資產管理 | TW |

| Wistron #8 | 中文簡介 | HQ |

| Barn Owl Technologies | 推出 AI + IoT 即時害蟲監測系統,協助農民減少化學使用、提升作物產量 | US |

| BRICKS | 無需編碼的 PaaS 平台互動式數位看板,實現即時數據整合與多螢幕拼接,提升業務靈活性。 | TW |

| LargitData | AI 輿情分析與企業智慧決策支援,幫助企業掌握市場趨勢、化解公關風險 | TW |

| POD Innovation | AI 先進駕駛輔助系統 (ADAS),運用感測器融合與數位孿生模擬,提高鐵路營運安全 | TW |

| Niyam AI | 專為 EMS 電子製造服務業打造的平台,提供即時設計驗證與風險評估,加速產品開發流程、減少出貨延遲 | SG |