SINGAPORE — As the AppWorks Accelerator program celebrates its 15th anniversary, the 30th Demo Day in Singapore served as a powerful showcase of the transformative trends reshaping Southeast Asia’s startup and venture capital landscape. The roadshow featured 18 pioneering startups spanning sectors from AI to Web3 and Deep Tech, with startups ranging from pre-seed to Series B sharing their vision and traction with an engaged audience of over 70 investors and corporates.

Founders, partners, and mentors gathered for AppWorks Demo Day #30 in Singapore

Founders, partners, and mentors gathered for AppWorks Demo Day #30 in Singapore

Underscoring the dynamic transformation taking place across Southeast Asia’s startup and venture capital ecosystem, several key trends have emerged, including:

- Deep Tech Takes Flight to Orbit

Once niche, fields like space tech, quantum computing, and advanced AI are now central to the region’s startup scene, driven by growing confidence in their potential to solve complex global challenges—from climate monitoring to secure communications.

- Aliena, a Singapore-based space tech startup, is pioneering the next generation of satellite propulsion with its compact, low-power MUSIC engines designed for small satellites operating in low-Earth-orbit (LEO) and emerging missions at very-low-Earth orbit (VLEO). Co-founded by Dr. Mark Lim and Dr. George-Cristian Potrivitu, Aliena spun out of academic research at NTU with a mission to make agile space mobility more accessible and mission-flexible. Backed by $9.3 million in total funding, including a recent $5.6 million Series A, Aliena’s plug-and-play thrusters are already flying in orbit, enabling high-resolution Earth observation, climate monitoring, and real-time communications. With a new 8,000 sq ft production and testing facility in Singapore, Aliena is scaling up to meet growing global demand—bringing the space frontier closer to Earth, and closer to commercial viability.

- Blockchain and Web3 Unlocking New Financial Frontiers

Blockchain technologies and decentralized finance (DeFi) are expanding rapidly in SEA, addressing the needs of the region’s large underbanked population. Startups are innovating in digital payments, microfinancing, and digital asset management to enable cross-border transactions and empower small businesses has received growing investor appeal.

- Founded by Ivan Kozlov, Resolv Labs is building a yield-scaling stablecoin that will serve as the underlying infrastructure for robust, delta-neutral yield strategies for both DeFi and TradFi. Their flagship stablecoin, USR, is designed to generate stable returns from crypto markets while effectively minimizing exposure to price volatility through sophisticated hedging. This innovative approach has resonated strongly with investors, propelling Resolv Labs to achieve an impressive Total Value Locked (TVL) of $350 million. Their focus on institutional-grade solutions, naturally extends to potential partnerships and integration with neobanks and other fintech platforms looking to offer innovative, yield-bearing financial products to their customer base.

- From Pond to Platform: The Digital Evolution of Farming

With climate pressures, disease threats, and rising global demand putting strain on traditional fish and shrimp farming, a new wave of startups is bringing modern solutions to make seafood production more resilient and future-ready.

- A standout example is JALA, an Indonesian startup leading the digital transformation of shrimp farming. JALA’s platform equips farmers with real-time data analytics, harvest forecasting, and access to financing, enabling smarter, more resilient shrimp cultivation. With over $60 million in shrimp production monitored, JALA exemplifies how digital tools can unlock productivity and sustainability at scale.

- AI as a Catalyst for Industry Transformation

According to the latest report by the World Economic Forum and ADB, Southeast Asia is not only experiencing accelerated AI adoption but is also building the foundational talent, infrastructure, and policy environment to scale its impact. At AppWorks Demo Day #30 Singapore, Peris.ai and Omo Protocol were two startups tackling critical infrastructure challenges in cybersecurity and AI.

- Indonesia-based Peris.ai is democratizing enterprise-grade digital security through hyperautomation, offering modular, plug-and-play tools that allow mid-sized businesses to manage cyber threats with minimal overhead. With an ARR approaching $1.2 million, the company is empowering organizations that traditionally lacked access to dedicated security teams—helping them defend against increasingly complex risks.

- Meanwhile, Omo Protocol, founded by Ali Hassan, is building the foundational rails for the next wave of AI development. Their upcoming OMO SDK, enables developers to effortlessly orchestrate and scale autonomous agents capable of direct interaction with smart contracts and other agentic systems. As interest in long-term, self-operating AI tools intensifies, Omo Protocol is emerging as a key enabler for developers and startups to deploy agents that can seamlessly engage with the on-chain environment.

Despite a global slowdown in startup funding, SEA’s ecosystem shows resilience. The AppWorks Demo Day #30 Singapore launched with an impressive lineup of 45 startups founded by 78 individuals representing 20 nationalities. Among them are 26 serial entrepreneurs, underlining the talent diversity and depth of experience in this batch.

More than 60% of the Demo Day #30 Singapore pitching startups already have a regional footprint, having gained strong traction in their home markets and now actively exploring expansion across Southeast Asia. The Demo Day roadshow — with stops in Taipei, Singapore, and Jakarta — highlights this momentum, showcasing scalable solutions that are being adapted for diverse consumer needs across borders.

This regional push exemplifies the collaborative energy among founders, investors, and corporates, and is essential for capturing Southeast Asia’s rapidly growing digital consumer base, projected to reach hundreds of millions of users.

Jamie Lin, Chairman & Partner, AppWorks, shares his journey and startup insights at the AppWorks #30 Kick-off

Jamie Lin, Chairman & Partner, AppWorks, shares his journey and startup insights at the AppWorks #30 Kick-off

Jamie Lin, Chairman & Partner, AppWorks, said, “We are truly proud to be presenting AW#30 startups to the venture investor community in Singapore and the Greater Southeast Asia. The AppWorks Demo Day #30 Singapore cohort reflects this region’s maturing ecosystem marked by experienced founders and growing diversity. Approximately 33% of them are serial entrepreneurs, and 18% of AW#30 startups have surpassed US$1 million in annualized revenue, signaling strong execution and market validation with clear paths to profitability. This maturity aligns with current investor preferences for sustainable growth. We are expecting this Demo Day to lead to many quality funding rounds.”

A remarkable 53% of teams are building in AI (24 teams), while 33% are pioneering in Web3 (15 teams). Notably, 69% (31 teams) hail from Southeast Asia, and 13% (6 teams) have established offices in Taiwan. The international reach of the program spans across 13 markets, including Singapore, Hong Kong, Indonesia, Vietnam , Malaysia, and more.

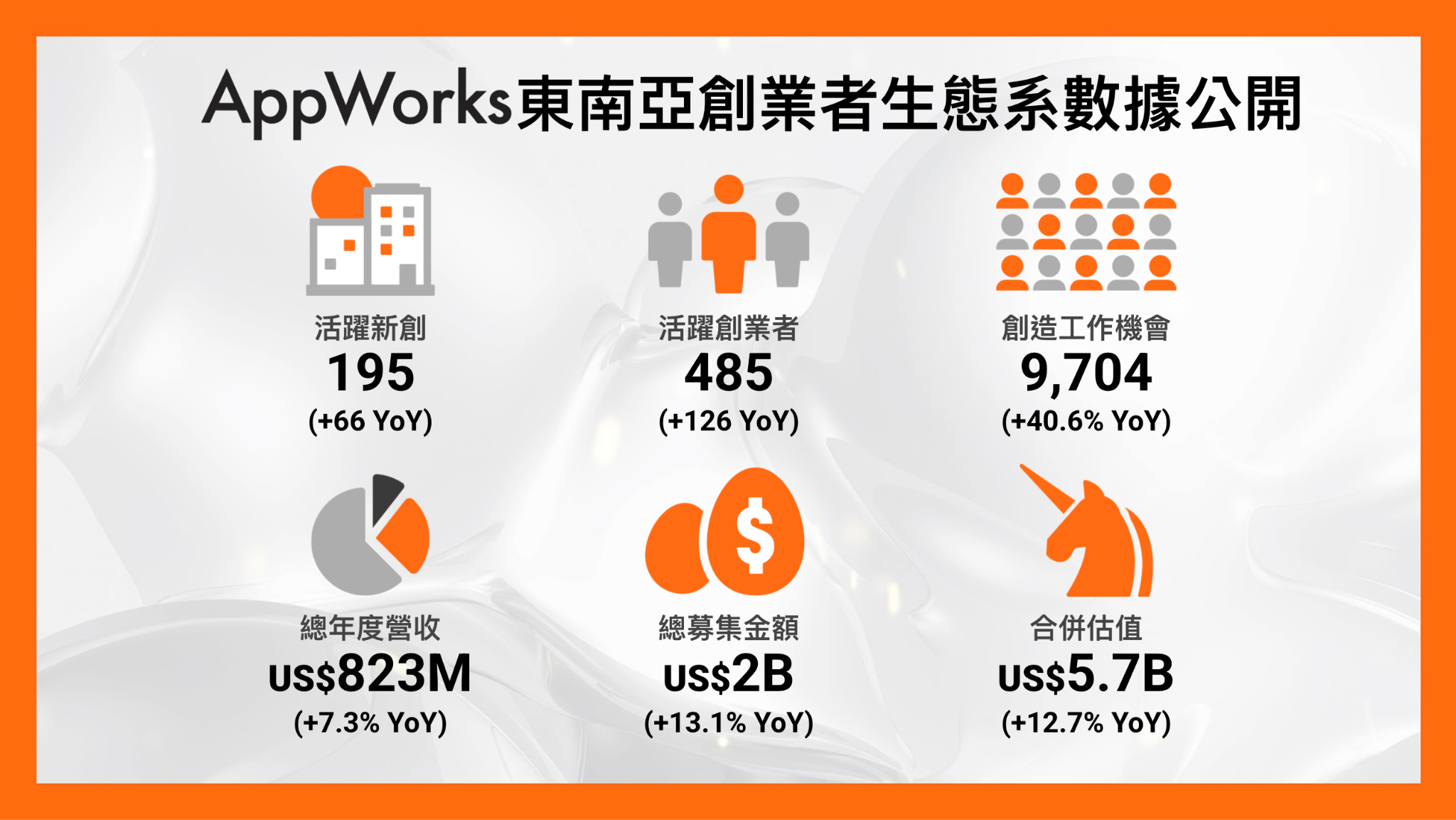

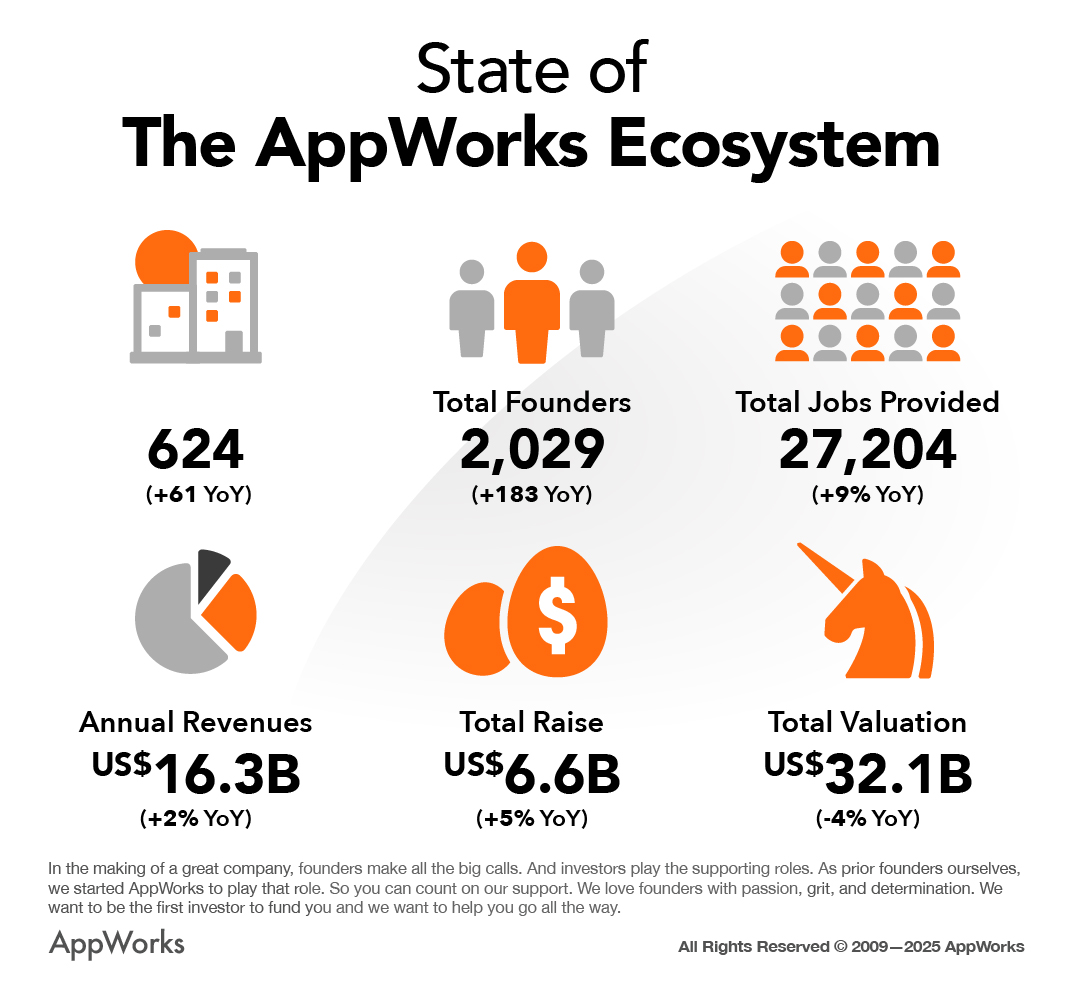

Across all cohorts, there are now 624 active startups—up 61 year-over-year—comprising 2,029 founders (+183 YoY). These companies have collectively raised $6.6 billion (+5% YoY), are valued at $32.1 billion, and generate annual revenues of $16.3 billion (+2% YoY) while employing 27,204 people globally (+9% YoY). Within the Web3 vertical, the community has grown to 146 active startups (+8 YoY) led by 410 founders (+56 YoY), who have raised $1.3 billion to date. These Web3 startups boast a combined valuation of $11.7 billion and report annual revenues of $600 million (+7.5%).

AppWorks is a leading accelerator and venture capital firm in Greater Southeast Asia, managing $350 million in assets under management (AUM). With an equity-free, no-cost accelerator program, AppWorks uniquely serves founders at all stages of growth across seven key markets—Taiwan, Singapore, Hong Kong, Indonesia, Malaysia, Vietnam, and the Philippines. With strong sub-communities, frequent alumni engagement, and a sticky network, AppWorks continues to be a launchpad for ambitious entrepreneurs building transformative businesses across AI, Web3, and beyond. For those interested to join the programme, please visit https://appworks.tw/accelerator/.

Below is the full list of bold and brilliant pitching teams from the AppWorks Demo Day #30 Singapore cohort – a true powerhouse of innovation, vision, and impact.

| TEAM NAME |

|

HQ |

ONE-LINER OF THEIR PRODUCT / SERVICE |

| Aliena |

Mark Lim |

SG |

Next generation satellite engines for small satellite missions |

| CarNow |

Duong Nguyen |

VN |

Multi-functional platform for used automotives, enabling safe and scalable financing for dealers |

| CocoMart |

Moses Chang |

TW |

An F&B supply platform simplifying restaurant procurement |

| Eazy Digital |

Harprem Doowa |

TH |

Salesforce for global insurers and brokers |

| HIO |

Jenny Bui |

VN |

An innovative service blending AI and personalized care for the elderly |

| JALA |

Liris Maduningtyas |

ID |

Technology and financing solutions for shrimp farming |

| Merito |

Brandon Possin |

JP |

Deep tech investment bank |

| Mezink |

Tarun Valecha |

SG |

AI-led service-as-software to help brands generate demand via social media |

| Munshot |

Chiraag Kapil |

IN |

An AI agent platform for research automation and monitoring for hedge funds and family offices |

| NarrativeAI |

Teddy Yip |

HK |

A vertical AI agent empowering fashion designers to connect with suppliers and bring their visions to life |

| Omo Protocol |

Ali Hassan |

SG |

Multi-agent orchestration protocol |

| Peris.ai |

David Samuel |

ID |

Zapier for cybersecurity with agentic AI tools |

| Resolv Labs |

Ivan Kozlov |

VG |

Delta-neutral stablecoin |

| Sentimint |

Yuri Choi |

SG |

The world’s first emotional memory vault on-chain |

| Toii Games |

Allen YU |

TW |

Toii Games creates an immersive gaming experience with XR and location based technology |

| TopSchool.ai |

Joseph Telfer |

SG |

Personalized learning AI agent platform for schools, improving performance & saving costs |

| Tova |

Pranay Periwal |

HK |

A private members’ club designed for curated social connections |

| Vulcan Augmetics |

Rafael Masters |

SG |

Revolutionizing human-machine interaction with AI-powered wearable sensor systems |

About AppWorks

Founded in 2009, AppWorks is Greater Southeast Asia’s leading startup accelerator and venture capital firm, supporting over 600 active startups and 2,000 founders. Its focus on AI, blockchain, and Southeast Asia (“ABS”) positions it at the forefront of the region’s digital transformation, providing founders with capital, mentorship, and a vibrant community. For more information, visit appworks.tw.