Editor’s note: Congratulations to LiveArtX on another great milestone. AppWorks is excited to be a part of the journey to connect the art world with web3. The press release from LiveArtX is below:

・$ART will provide holders with exclusive access to the physical & digital art worlds across the entire art ecosystem.

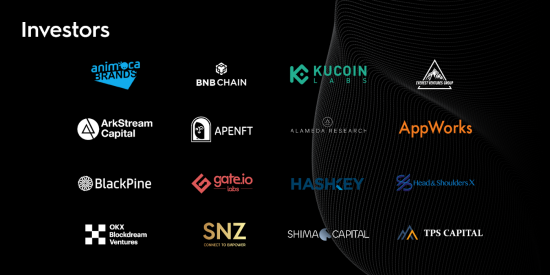

・More than $4.5 million already committed by leading investors

including animoca brands, BNB chain fund and KuCoin.

LiveArtX, the premium NFT platform that connects the art world with Web3, is pleased to announce the launch of $ART, a token that provides utility across both the physical and digital art worlds. Holders of the $ART token, the very first of its kind, will gain entrée to the art world, including access to the best of physical and digital art, participation in exclusive art experiences and events, advance notice of drops, a role in platform curation, and membership in the LiveArt DAO. More than $4.5 million has already been committed from prominent blockchain innovators and crypto investors, led by Animoca Brands, Binance and KuCoin, followed by AppWorks, Alameda Ventures, OKX BlockDream Capital, Gate Labs, HashKey, APENFT Foundation, SNZ, Shima Capital, ArkStream Capital, Head&Shoulder Financials, Kikitrade, and Aspen Digital.

LiveArtX is a strategic partnership between LiveArt — founded by art industry leaders including former senior executives of Sotheby’s and Christie’s — to bring access, transparency, and digital solutions to the traditional art world — and Everest Ventures Group (EVG), the blockchain investor and incubator.

Boris Pevzner, Co-Founder and CEO of LiveArt, commented, “The $ART token serves as the ultimate bridge between the physical and digital art worlds. It is the cornerstone of LiveArt’s strategy of blending technology, innovation, and deep knowledge of the art market. We believe in a future art world that combines the best of the traditional art industry with the power of Web3 technology and crypto communities. And that’s why we created LiveArtX with our partners at EVG — a platform with digital and physical art, with purchases made in crypto and cash, with exhibitions in the real world and the metaverse — all underpinned by the $ART token.”

Allen Ng, CEO of EVG and Co-Founder of LiveArtX, said, “Blockchain opens up a lot of overdue possibilities for artists and collectors. But technology can’t do it alone. With the unparalleled art market know-how from the team of LiveArt and now the strong backing from the Web3 community, LiveArtX is going to bring fresh innovation to one of the oldest asset classes of mankind.”

LiveArtX serves the entire art ecosystem. Artists can mint their works in the LiveArtX Creator Hub with powerful rights management and unbreakable resale royalties. Collectors can access a curated selection of only the best artworks on the LiveArtX Marketplace. The White Label Suite enables galleries and partners to launch and manage their own NFT marketplaces, or work with the LiveArtX Studio to curate and market drops. And the LiveArtX Developer Lab empowers the most advanced coders to work with our innovative technology.

The team behind LiveArt includes seasoned art market and technology professionals led by Adam Chinn — founding partner of the international art advisory firm, Art Intelligence Global, and former Chief Operating Officer of Sotheby’s; John Auerbach — CEO of UOVO, the premier provider of fine art and collections storage and services, who previously held senior e-commerce roles at Sotheby’s and Christie’s; and digital entrepreneur Boris Pevzner — whose numerous credits include the development of Collectrium (acquired by Christie’s) and xfire (acquired by Viacom). The leadership team also includes George O’Dell, a veteran Contemporary Art specialist who spent the past 13 years at auction houses in London and New York; and Marisa Kayyem, an art historian and art advisor who was the Director of Education at Christie’s.

About LiveArtX

LiveArtX is a premium NFT platform that connects the art world with web3. Built by art industry leaders, LiveArtX brings creators, collaborators, and collectors into the metaverse. LiveArtX, together with LiveArt.io, provides the ultimate bridge between the physical and digital art worlds — blending technology, innovation, and deep knowledge of the art market.

[If you are a founder working on a startup in SEA, or working with AI, Blockchain, and NFT, apply to AppWorks Accelerator to join the leading founder community in Greater Southeast Asia.]