Editor’s note: Congratulations to Parcel on another great milestone. As the virtual real estate economy grows, Parcel aims to be the leading one-stop-shop for landowners and creators in the metaverse. AppWorks is excited to be a part of the journey. The press release from Parcel is below:

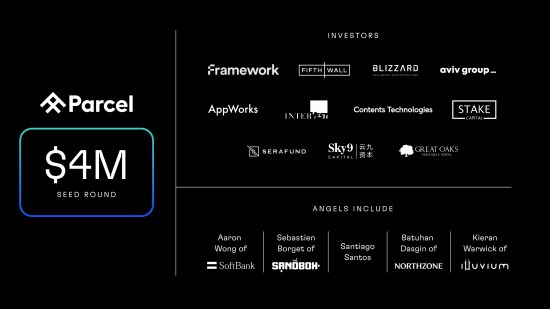

Parcel, an NFT marketplace for virtual real estate, has raised $4 million in a seed round led by Framework Ventures, a venture capital firm known for its early entry into Web3 and decentralized finance (DeFi). Additional participants in the round include Fifth Wall, Blizzard Fund (Avalanche), AVIV Group (Axel Springer), AppWorks, Great Oaks, and Serafund; as well as an impressive roster of angel investors including Aaron Wong (SoftBank), Sebastien Borget (The Sandbox), and Santiago Santos.

By aggregating digital land listings and architectural services for virtual landowners, sellers, and builders, Parcel is the first comprehensive marketplace tailored exclusively for the virtual real estate economy. Parcel launched in July 2021 amidst a virtual real estate market that generated more than $500 million in sales in the 2021 calendar year and has already surpassed $1 billion in sales during the first half of 2022. The platform aggregates real estate listings across several of the largest virtual worlds on the Ethereum blockchain, including The Sandbox, Decentraland, Voxels, Somnium Space, Mona, and NFT Worlds. Multi-chain support on Avalanche and Polygon is planned for later this year.

Parcel’s marketplace offers interactive, data-rich visual maps to help users more seamlessly navigate the virtual real estate ecosystem. Parcel also provides real-time price appraisals for open listings and utilizes a proprietary gas-efficient smart contract to facilitate sales, enabling users to buy and list land for half the cost of gas fees found on existing NFT marketplaces. For a limited time, Parcel is reimbursing gas costs for wallets that list land on its marketplace.

“The ongoing growth of the digital land ecosystem presents endless opportunities for creators and investors,” said Noah Gaynor, Co-Founder and CEO of Parcel. “However, to build a truly successful metaverse economy, users need a marketplace solution that not only encourages the sale and transaction of digital land, but the development of valuable projects and businesses across virtual worlds as well. By aggregating resources for all metaverse stakeholders – from prospective landowners and sellers to virtual world service providers and architects – Parcel provides the full suite of services needed to build a thriving metaverse.”

To encourage the development of diverse projects and services across virtual worlds, Parcel is developing a comprehensive creative directory known as Creatorverse. Through Creatorverse, landowners will be able to easily discover and employ virtual architects and service providers by browsing their portfolio of digital work. Parcel also offers Learn, an educational platform that helps seamlessly onboard new users and advance knowledge for the Web3 community.

“Though the metaverse land market has grown rapidly over the last year, the market is still quite fragmented between various virtual worlds,” said Michael Anderson, Co-Founder of Framework Ventures. “We believe Parcel is uniquely positioned to unify the virtual real estate ecosystem and lead the development of an open and thriving metaverse. We’re very proud to work alongside their team as they become the leading marketplace for the virtual real estate economy.”

The funds from the round will be utilized to continue developing Parcel’s feature set for the Creatorverse and expanding marketplace listings to virtual worlds beyond the Ethereum ecosystem.

About Parcel

Parcel is on a mission to empower people with the tools they need to find their home in the metaverse. Born out of an industry that was scattered and lacked transparency, Parcel developed the first comprehensive marketplace tailored exclusively for virtual real estate. By aggregating digital land listings and fostering connection between landowners and creators, Parcel offers the full suite of services needed to build a thriving metaverse community and economy. To learn more, visit https://parcel.so and join the community on Twitter @ParcelNFT.

If you’re a founder working on web3 / DAO, AI / IoT, or Southeast Asia, you’ve come to the right place! Applications for AppWorks Accelerator