In mid-July, we will host an in-person Demo Day in Taipei, Taiwan, featuring startups that are facing the Taiwan market. We thought it would be great for the founders to showcase their product and team to the wider startup community from across the region and our network through a virtual Demo Day.

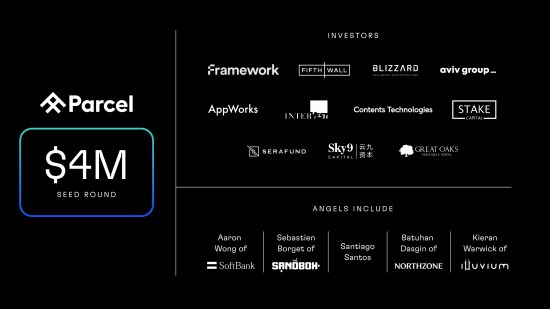

This past half year, AppWorks Accelerator recruited 24 teams across AW#24, with 51 founders from 12 different home markets, including Indonesia, Thailand, the United States, Singapore, and Hong Kong—with 17 Taiwan-based teams. The batch included 10 female founders (20%) and 20 serial founders (42%). Half of the batch’s founders are building projects for the web3 era.

This particular demo day will feature 12 startups, with many in the NFT / blockchain space to give you a glimpse into our digital future. We will hold an exclusive livestream for investors and corporate representatives on YouTube at 9 am (GMT+8) June 28th. The video will be officially open to the public after the exclusive 2-week campaign.

You can find a brief introduction to each pitching team and founder below:

1. The Iterative Collective: Incubator, developer & publisher for games

Matthew Quek | [email protected] | theiterative.co

2. Protico: Web3 chatting network

Howie Young | [email protected] | Protico | Web3 Chats

3. Labfront: AI tools for health research

Chris Peng | [email protected] | labfront.com

4. PaperPlane by FlyingClub: NFT with IRL drinking utility

Larry Tu | [email protected] | flyingclub.io

5. Envio: Full-service digital logistics & supply chain enabler for SMBs

Richard Cahyanto | [email protected] | envio.co.id

6. BitShine: Fiat on-ramp and off-ramp for companies

Claire Chen | [email protected] | bitshine.app

7. Aibou: Helping SMBs grow and scale, with automation and data insights that matter

Bouchen Kuo | [email protected] | aiboucrew.com

8. Alphalytics: On-chain data aggregator

Anne Winterson | [email protected] | alphalytics.ai

9. Blueberry Tech: Business aggregator app

Eric Lin | [email protected] | blueberrytech.io

10. PreTeeth AI: AI tools for dental smile design

Bill Chou | [email protected] | aidirect.com.tw

11. ZTO: Web3 social media

Lenny Fan | [email protected] | ztocoin.com

12. Storius: Geotagged audio sharing app

Freddy Law | [email protected] | storiusapp.com

If you are an investor or corporate representative and need more detailed information about the teams or want to connect with AW#24 founders, please email us at [email protected].

We welcome all web3 / DAO, AI / IoT, or Southeast Asia founders to join AppWorks Accelerator.