Nathan Alexander, Associate

Nathan joined AppWorks in 2024 as an Associate in the Southeast Asia Arm, dedicated to meeting and supporting founders in the region. He brings forth over 7 years of experience in startup advisory, investments and M&A. He started his career at PwC Indonesia where he was first exposed to the investment world and developed his initial acumen for analyzing companies. In 2021, Nathan moved to the venture capital industry, taking on the position of Senior Analyst at Alpha JWC. In his most recent role, Nathan served as the Head of Investments for Telkomsel Ventures where he focused on sourcing startups and underwriting investments for Telkomsel, Indonesia’s largest telecom operator.

It might be uncomfortable but less is often more in making a tech product. In this article, I want to highlight a company in our ecosystem that grew rapidly not by piling on features, but by consciously removing complexity.

Why Simplicity Matters: Learnings from 91APP

Here’s something founders often overlook: users don’t actually crave more features; they crave less friction. Adding more features might sound impressive, but every extra click, screen, or step can turn users away.

I see a strong case of 91APP, one of the startups in our community that had successfully gone IPO in Taiwan. 91APP is a storefront SaaS solution for merchants. Unlike many other solutions that overwhelm merchants with complicated setups, convoluted integrations, and steep learning curves, 91APP built their entire platform with one core principle: make omnichannel retail ridiculously easy. No complex integrations, no tech-heavy setup, just effortless retail management.

91APP helps merchants to quickly create a fully functional online store/website and branded mobile app within days, sparing them all technical complexities. Its unified, simple dashboard integrates everything, from online and physical retail to payments and marketing channels, allowing brands to manage their entire omnichannel retail experience all in one platform.

91APP’s success stems from its deliberate simplification of complex retail processes. The platform makes it easy for anyone, even non-tech-savvy merchants to quickly launch and manage an omnichannel retail experience. But 91APP’s simplicity mindset extends beyond just the product:

- Intuitive User Interface: Easy-to-navigate interfaces with clear, jargon-free language.

- Straightforward Pricing: Transparent, simple subscription models with no hidden fees.

- Seamless Integrations: Effortless OMO integration to sync inventory, member data, employee performance, and loyalty programs across their online store and physical shops with ease, eliminating the need for manual management after launching.

By deeply understanding their customers, 91APP added a simple built-in referral mechanism, giving each store staff a unique code that earns them a commission on sales from both e-commerce and physical stores. This OMO integration not only boosts staff bonuses but also encourages them to embrace digital channels to maintain customer influence. Many businesses benefited a lot through increased sales performance after adopting this straightforward, yet highly effective feature. This enables 91APP’s merchants to scale faster and spend less time on problems that don’t move the needle.

Timberland was struggling to unify their offline and online operations. 91APP’s OMO (Online-Merge-Offline) solution allowed Timberland to integrate inventory, member data, and loyalty programs across both their online store and physical shops, eliminating the need for manual management. After implementing this solution, Timberland saw 70% of online sales from the brand’s official e-commerce, and their OMO members spent twice as much as single-channel customers.

91APP’s success demonstrates that simplicity is not just about removing unnecessary features—it’s about deeply understanding user needs and creating an experience that minimizes friction. Their approach shows that when technology is simplified and made intuitive, it can lead to faster growth, higher engagement, and stronger customer loyalty—proving us one thing: simplicity matters.

Keeping Simplicity in the Age of AI

Talking about product development right now would be incomplete if we don’t consider AI. The truth is AI brings immense potential and…complexity. 91APP recognized that adding AI shouldn’t mean adding friction. They integrated AI silently and intuitively:

- Retail AI Jooii: Automatically recommends the best pricing and promotions using real-time shopper data, no manual setup, just smart suggestions built into the dashboard.

- One-Click Copywriting: Generates product descriptions and ad copy in seconds, removing the need for writing or marketing expertise.

- Smart Insights: Converts raw data into clear, actionable reports, so even non-technical users can make fast, informed decisions without digging through spreadsheets.

The beauty of 91APP’s approach here is they make AI feel like part of the background, not the focus. Instead of overwhelming users with tech, they’ve built tools that simply work, helping merchants with things like pricing or copywriting without adding complexity. That’s the real power of AI: when it becomes invisible, solving big problems without anyone noticing. It’s proof that even in the age of AI, simplicity isn’t just possible, it’s the best way to grow.

Why simplicity is harder than it looks

When I found out the power of simplicity, then the next question would be: if simplicity is so valuable, why not more companies do it? People often hear “keep it simple” and nod along, until they try to do it. On paper, stripping features sounds easy. In practice, it’s one of the hardest things a company can pull off. I tried to dig deeper and found there are at least three main reasons why it’s difficult to achieve.

First, simplicity means saying “no” over and over. It’s easy to keep adding features because every “yes” feels like progress. But each “no” risks disappointing a customer, investor, or salesperson. Most companies simply don’t have the courage and discipline.

Second, simplicity isn’t cheap. Behind 91APP’s’s easy storefront are years of hidden engineering effort. It takes huge technical depth, custom infrastructure, optimized code, and endless tweaking to make complex technology feel invisible. It’s easier to expose complexity than hide it. The shorter the grass, the deeper the root.

Third, simple products must be opinionated. A customer-centric founder will know exactly what their customer needs. 91APP deeply understood the needs of merchants and how they wanted to manage omnichannel retail, so they built a platform that streamlined the process and removed unnecessary complexities. This deep understanding of their customers allowed them to focus on the core value they were delivering, even if it meant overlooking other potential use cases. Many companies fail to be so customer-obsessed, and that lack of focus can lead to overcomplicated products that don’t truly address what users want or need.

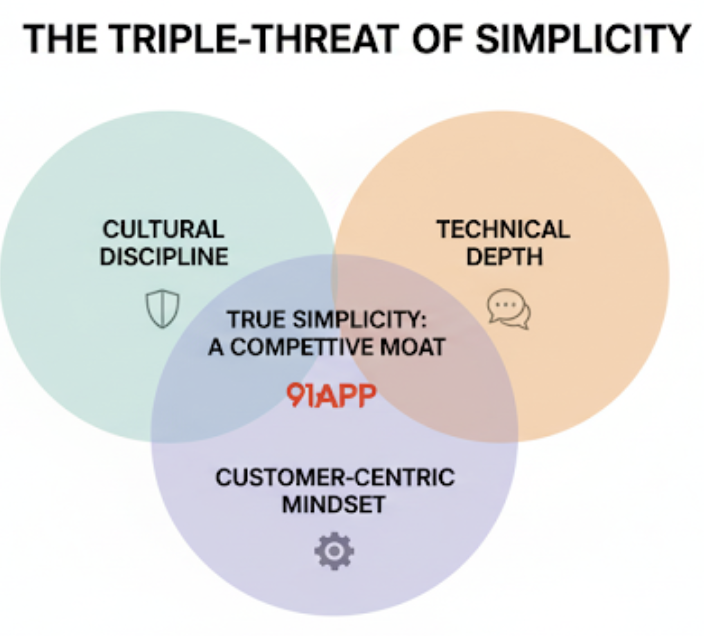

Simplicity only looks easy from the outside. It actually requires cultural discipline, technical depth, and a customer-centric mindset. Few teams are willing or able to invest in all three, which is why true simplicity remains a competitive moat rather than a commodity.

Conclusion

The big lesson here is clear: complexity might seem impressive, but simplicity holds real value. Founders are often tempted by new technologies, mistakenly believing complexity equals sophistication. Yet, the real winners succeed precisely because they reject unnecessary complexity and maintain relentless focus on their users’ needs.

But embracing simplicity isn’t easy, it’s incredibly difficult. It demands the courage to say “no” repeatedly, even when it disappoints stakeholders. It requires deep technical mastery to hide complexity beneath the surface. And it needs bold, opinionated decisions coming from deep understanding of the customers, which will clearly define the product’s direction, despite the risk of alienating some users and stakeholders.

True simplicity is a competitive advantage precisely because it’s so hard to achieve. It involves deliberate cultural discipline, constant technical refinement, and unwavering commitment. When done right, simplicity doesn’t just grow businesses, it transforms them.