By Sophie Chiu, AppWorks Principal

It’s been a year since I first met Rahul through one of his early angel investors. Although I am not an expert in industrial automation, the conversation struck my interest immediately because the core of what Botsync does – the integration protocol among the devices in an industrial environment — is somewhat relevant to my husband’s vision for his smart home startup. There are a lot of similarities in the business nature and challenges for both companies, which led to many common topics I myself have had with the founder in my household. So my conversation with Rahul became weekly even till now; we would exchange ideas about where the business model should evolve, whether integration has a big enough commercial value, how a distribution strategy can enhance the moat, and even whether a small startup could stand a chance in such a topic competing to serve mostly large or even mega manufacturers.

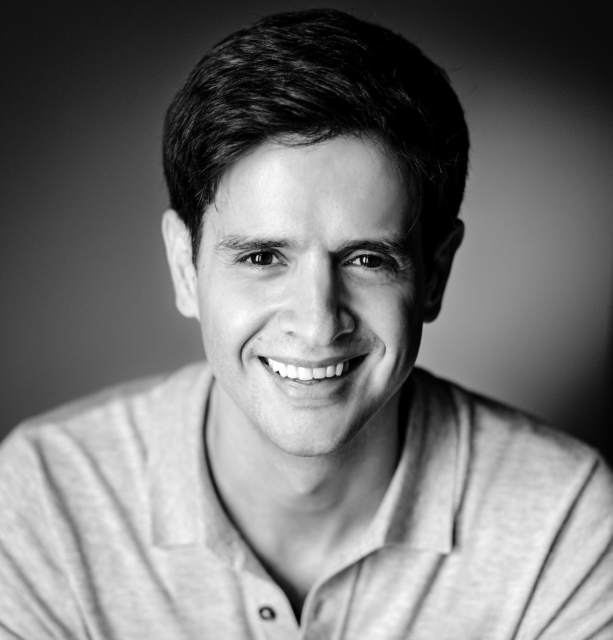

Rahul has been on this journey for a long time since college. I can sense his deep knowledge and grit, but most importantly is his genuine passion that keeps him rolling forward for so many years. Hence, this article shares why we invested in him and Botsync. Outside my personal interests, AppWorks is in a strong position to support Botsync as we have an extensive network of manufacturers in Taiwan and across Southeast Asia.

Rahul, The 29 Year Old CEO From Rock to Rolling Stone

Choosing the startup path is usually not a planned decision. Rahul and his three co-founders met during a robotics competition at Nanyang Technological University in Singapore. They worked on several robotics projects for their school, and these consultancy opportunities eventually led them to start Botsync right after college in 2017. Initially, it was simply an advisory shop. However, the startup journey is never easy and often involves a steep learning curve. Soon, Rahul realised he wasn’t an effective CEO; his pitching skills were lacking, and his company didn’t have a scalable model. Frustrated, he deeply reflected on his life and upbringing, questioning what shaped his character and behaviour.

Rahul grew up in an Indian family that immigrated to Abu Dhabi. It was a humble background in a highly religious environment. He was highly disciplined, adhering to a frugal principle and focusing on studying well and playing cricket at a professional level. His passion for robotics drove him towards an engineering path. He had to maintain a GPA above 4.8 to keep his scholarship at NTU, which meant working hard and missing out on typical college experiences. Looking back, his frugal mentality, religious background, pressure to maintain high scores, and rigorous engineering training all made him a rigid social behaviour like a rock. He forced himself to try new things, such as backpacking trips and social drinking and questioned his religious beliefs. Eager to improve, he observed notable CEOs and reflected on what he might be missing. He attended early-stage startup pitches, paid attention to those who performed well, and deliberately reached out to connect with them and stay friends ever since. Like a scout focused on self-improvement, he learned from peer founders, some of whom have now evolved into successful growth-stage entrepreneurs.

The transformation period from 2017 to 2022 was significant not only for Rahul but also for Botsync. Under his leadership, Botsync pivoted from an advisory shop to selling hardware robots, and now, it is finding its product-market fit in robotic automation software. At 29, Rahul has experienced the journey from high hopes of uninformed optimism to a trough of informed pessimism and now back to informed optimism. He is aware of his strengths, including long-built self-discipline, strong motivation, and a genuine passion for robots. He also recognises areas where he needs to continue deliberate practice to catch up. From rock to rolling stone, this transformation is not just a choice but a necessity because Botsync operates in a challenging segment for small startups.

Robotics Technology Is The Next Milestone for Industrial Automation

Industrial automation has been part of human progress since ancient times. From the water wheels of the 1st century and the Industrial Revolution of the 17th-18th centuries to electrification in the 20th century, programmable logic controllers (PLCs) and robotic arms in the 1960s, and now ‘Industry 4.0’ based on advancements in computers and the internet since the 1980s. Many successful companies have achieved extreme efficiency through industrial automation, such as TSMC in Taiwan, Toyota in Japan, and Amazon in the US.

Robotic technology thrives under this backdrop. It has yet to reach its mature stage. AI could also further speed up its evolution. As it continues to advance, robotic technology would be the next milestone for industrial automation after computers and the internet. Industrial robots flourished after ABB and Kuka sold the first commercial robots in the 1970s. The invention of cobots (collaborative robot) in the late 1990s further advanced the industry. While traditional robots execute tasks independently, cobots are designed to physically interact with people in shared workspaces. The team behind Universal Robots, a leading robot supplier in the world, applied their expertise to build a new era of autonomous mobile robots (AMRs) to replace rigid autonomous guided vehicles (AGVs) in intralogistics. They founded MiR in 2011, acquired by Teradyne for over US$270M in 2018, marking a significant milestone for AMRs and inspiring many startups in this space, including Botsync.

The Need of A Standardised Communication Protocol Among Robots

Robots have significantly replaced human labour, but true automation requires seamless interaction between all components (robots and stations). This challenge remains in industrial environments where robots come from various brands and vendors. As robotic technology advances and costs decrease, the variety of robots will increase, making integration even more complex. Standardised communication protocols are currently missing, but they are the key to designing automatic processes. This is what Botsync is striving to achieve.

Many large manufacturers in Taiwan have teams of hundreds of engineers to handle automation across production lines and robots. Smaller manufacturers, however, often cannot afford this and must hire external vendors to spend weeks on the integration. No major player dominates this space yet due to the complexity and effort required to integrate various robots and machines, potentially requiring a network effect.

Botsync, a team of young engineers, recognized this opportunity and is now commercialising the operating system initially built for their in-house AMRs. Integration is a new concept requiring a top-notch strategy to win the market quickly. AppWorks is investing in Botsync to support the team with our extensive manufacturer network in Taiwan, an ideal market for testing industrial automation products. Our goal is to help founders stay ahead, and we are excited to be part of Rahul’s journey.