Dramatic shifts in consumer behavior and social awareness have created demand for new categories of startups to address emerging consumer demands around social commerce, sustainability, and privacy.

TAIPEI, TAIWAN—June 12, 2024—AppWorks Accelerator, Greater Southeast Asia’s largest startup community, today held its 28th demo day (AW#28), unveiling 17 startups embracing AI to transform enterprise and commerce for a new era. The batch featured companies connecting social commerce with offline channel logistics, innovative payment solutions, and new applications for blockchain and AI—building tools and infrastructure for a more socially-connected, privacy-concerned, and digitally-conscious generation of businesses and consumers.

AppWorks Accelerator #28 (AW#28) demo day featured a total 16 teams on stage. As a batch, AW#28 hosted 38 innovative companies, with founders hailing from 17 different countries and regions, including Greater Southeast Asia, the United Arab Emirates, South Korea, the United States, France, Finland, and beyond. The batch featured several serial founders and 20% of participating startups were founded by female founders. The diverse geographic background of AW#28 illustrates the increasing globalization of tech entrepreneurship, as founders are building both global and hyperlocal solutions with AI to solve enterprise and commerce challenges around the world.

AW#28’s demo day featured the following companies:

- ADPList: A global mentorship platform to access knowledge from experts (Singapore)

- XO: AI-powered and blockchain-verified conversational platform for Gen Z (Taiwan)

- Borong: B2B bulk e-commerce platform (Malaysia)

- EQUO: A one-stop-shop omnichannel platform of curated, high-performance, quality products for the conscientious consumer (Vietnam)

- Orderfaz: Shopify for social commerce sellers (Indonesia)

- Event Horizon: DAO meta-governance layer (United States)

- Return Helper: End-to-end solution for cross border e-commerce returns (Hong Kong)

- ShipAny: Smart logistics gateway for e-commerce (Hong Kong)

- ABConvert: Specialized A/B testing tool for e-commerce (Taiwan)

- Ajourney: One-stop HR & payroll platform for businesses in Southeast Asia (Singapore)

- Quantlytica: AI-powered crypto asset management infrastructure (Finland)

- Olli: AI-powered operating system for toy manufacturers to turn toys into children’s personalized companion (United States)

- Qiro Finance: On-chain private credit protocol (Singapore)

- Exchequer Finance: Allows projects to self-insure token risk, incentivizing users with time premiums instead of tokens (Singapore)

- Jomud: Digitized career consultation using AI for university (Hong Kong)

- Cheko: Bridging students with subject experts for homework assistance (Philippines)

Many startups today were formed during the disruptive years of the pandemic, building solutions to address a world emerging from disruption and permanent changes in consumer behavior.

ADPList was born out of the COVID era, founded by Felix Lee. Initially launched to provide support to people who lost their jobs during the pandemic by connecting job seekers with recruiters, ADPList accumulated 300,000 active members and 25,000 mentors from major companies like Netflix, Airbnb, Google, and others with over 60% retention rate, receiving backing from Peak XV Partners. Differing from existing options like LinkedIn, ADPList attracts users looking for life and career guidance and building meaningful connections with professional peers and mentors.

Another startup launched to address the loneliness prevalent during the pandemic is XO—an anonymous dating software that uses blockchain technology to protect privacy and improve account credibility, utilizing AI to facilitate greater interaction around topics of interest and build empathy. With strong traction, XO has received investment from Rakuten and has gained international traction among Gen Z users.

AW#28 featured many companies that are building solutions for social commerce and logistics in Southeast Asia, tapping into a large youthful demographic base and steady economic growth in the ~5% range for the foreseeable future.

Founded by Aizat Rahim, Malaysia-based Borong is leading the integration of B2B e-commerce channels in Southeast Asia, with a gross transaction volume of nearly US$1 billion in 2023. With backing from Y Combinator, Borong has achieved a compound annual growth rate (CAGR) of 162% and repeat purchase rate of over 75%, as the company seeks to create an omnichannel logistics ecosystem penetrating throughout Southeast Asia and beyond.

Indonesia-based Orderfaz is creating a Shopify-style experience for social commerce merchants, integrating and managing orders on major platforms like TikTok Shop, Shopee, and Lazada. Launched in 2023 to help merchants improve conversion rates and manage product inventory, Orderfaz is now generating over US$1 million in monthly revenue, with plans to expand to Malaysia. Founded by serial entrepreneur Reynaldi Gandawidjaja, Orderfaz has received backing from 1982 Ventures.

As more people become concerned with our impact on the environment, startups are creating solutions to promote sustainability and minimize carbon footprints. Vietnam’s EQUO develops 100% plastic-free straws, tableware, plates and drinkware, made of degradable and environmentally-friendly materials such as sugar cane, coconut, coffee and rice. Launched in 2020 by Marina Tran-Vu, EQUO has achieved an annual recurring revenue (ARR) of US$1.6 million and provides products to over 18 countries around the world.

“Over the past 14 years, from our humble roots in Taiwan, AppWorks has developed into a large regional startup network. With the addition of AW#28, we have now nurtured 563 active startups in 14 years. Among them, 30% have successfully raised Series A funding or beyond, and nearly 100 can be considered large enterprises with revenue exceeding US$6 million or have successfully completed IPOs/IEOs. Additionally, there are nearly 100 hidden champions that have achieved sustained profitability through bootstrapping,” said Jamie Lin, Chairman & Partner, AppWorks. “These diverse startups form a complete ecosystem, with large enterprises providing platforms and business opportunities, and hidden champions offering unique solutions. This allows the AW#28 cohort to quickly establish countless synergistic collaborations.”

Wistron Demo Day Continues to Showcase Startups Building for a Connected World

In partnership with AppWorks, Wistron Accelerator has been running since 2021 and has featured 24 teams so far, focusing on companies in AI, cloud, healthcare, information security, IoT, and other cutting-edge sectors. Wistron Accelerator allows startups to conduct Proof of Concepts within real-world scenarios in Wistron Group and together explore avenues of growth over the next decade.

Wistron Demo Day #6 Featured:

- Etiq AI: A predictive model software to identify data & model issues, and provide optimization recommendations (United Kingdom)

With the rollout of AI in enterprises around the world, many stakeholders remain skeptical on the accuracy and accountability of AI systems. Founded by experienced business and data science professionals, Etiq AI develops APIs designed to optimize AI decision-making models. By testing data quality and model performance, Etiq AI can detect errors flexibly and quickly, allowing data scientists to fully understand the data they deploy in their AI models and reduce errors, helping business decision-makers gain a clearer understanding of the AI decision-making process to improve transparency, compliance, and accountability.

AppWorks: An Ever-Growing Startup Ecosystem

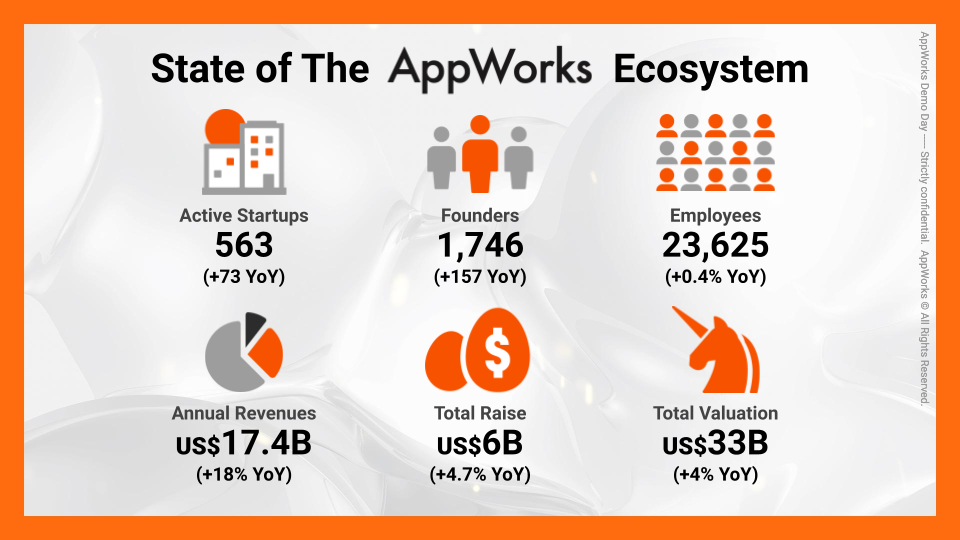

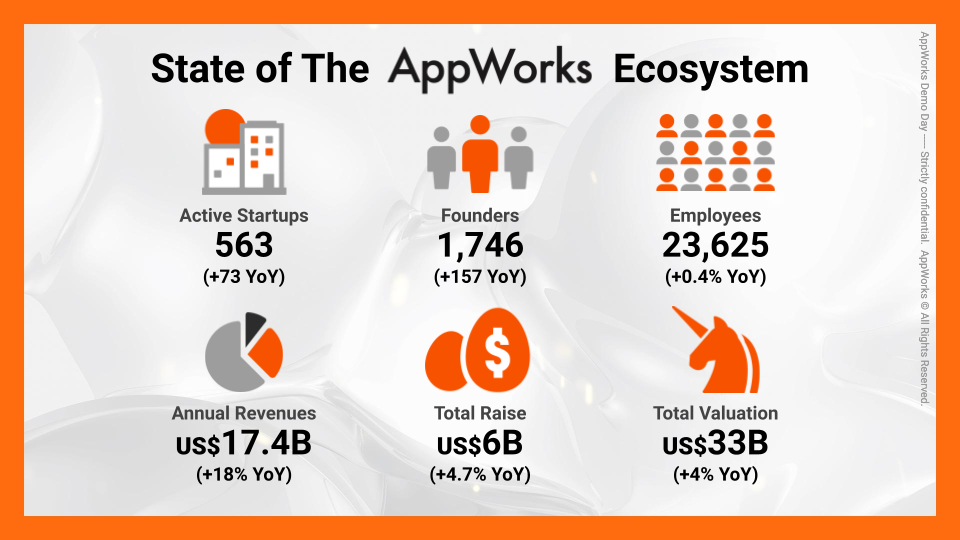

With the addition of AW#28, there are now a total of 563 active startups and 1,746 founders in the AppWorks Ecosystem. These companies collectively generate US$17.4 billion in revenue, employ 23,625 individuals, and have raised US$6 billion in funding with an aggregate valuation reaching US$33 billion.

With the addition of AW#28, there are now a total of 563 active startups and 1,746 founders in the AppWorks Ecosystem. These companies collectively generate US$17.4 billion in revenue, employ 23,625 individuals, and have raised US$6 billion in funding with an aggregate valuation reaching US$33 billion.

AppWorks #29 and Wistron Accelerator #7 are currently recruiting for their cohorts, with applications closing on July 25, 2024, and will launch in September 2024, with startups building solutions for AIoT, smart manufacturing, and cloud-based services are encouraged to apply. AW#29 will offer founders the opportunity to participate in intensive exchange and learning activities in Taiwan and Southeast Asia to learn from entrepreneurs throughout the region. These include exchanges with fellow founders, office hours with mentors and AppWorks partners and Wistron senior leadership, demo days with investors from Taiwan and Southeast Asia, and customized market exploration itineraries. The batch will help entrepreneurs connect with AppWorks’ founder and alumni network to support and learn from each other.

About AppWorks

Founded in 2009, AppWorks is a leading startup community and venture capital firm built by founders, for founders. We are committed to backing the next generation of entrepreneurs in Greater Southeast Asia (ASEAN+Taiwan) and helping them facilitate the region’s transition into the digital age. Just as how mobile and the internet completely transformed the status quo, we believe the current era of technology is currently being defined by major three paradigm shifts: AI, Blockchain, and Southeast Asia (ABS).

As such, whether it’s mentorship, investment, or talent, AppWorks has established a one-stop-shop for ambitious founders willing to bet against the consensus and drive a change they want to see in the world. We help startups build disruptive businesses from even an inkling of an idea into world-class enterprises through our three primary lines of service: Accelerator, Funds, and School.

More information: appworks.tw

AppWorks Accelerator

AppWorks Accelerator is a launchpad for bold and ambitious entrepreneurs targeting Greater Southeast Asia (GSEA). Every six months, we take in startups with strong potential, equipping founders spanning all walks of life with the necessary resources, mentorship, and guidance to get their ventures off the ground.

There are now a total of 563 active startups and 1,746 founders in the AppWorks ecosystem. Collectively, all companies in the ecosystem generate annual revenue totaling US$17.4 billion, and have created 23,625 jobs (+0.4% YoY). Altogether, the ecosystem raised a total of US$6 billion (+4.7% YoY), with an aggregate valuation reaching US$33 billion (+4% YoY). The AppWorks web3 ecosystem now has 133 startups and 324 founders. AppWorks web3 companies generated revenue totaling US$519 million, and raised US$1.1 billion (11.2% YoY), with an aggregate valuation of US$14 billion (+6.9% YoY).

More information: appworks.tw/accelerator

AppWorks Funds

AppWorks manages four venture capital funds totaling US$350 million, collaborating with investors who share our vision, including leading enterprises in sectors spanning technology manufacturing, finance, and media and telecom. We invest in startups ranging from Seed Round to Series C and fund around 20 to 30 deals a year, now with 100 names in our portfolio, including leading startups in several verticals such as Lalamove, Dapper Labs/Flow, Animoca Brands, 91APP, Figment, Carousell, ShopBack, 17LIVE, and KKday, while having produced six IPOs (Uber, GameSparcs, Kuobrothers, Pcone, 91APP, 17LIVE), four IEOs, one hectocorn, two decacorns, and five unicorns.

More information: appworks.tw/investments

AppWorks School

Established in 2016, AppWorks School has strived to cultivate a pipeline of skilled digital talent to help our community meet the technical demands of tomorrow. Quality talent has always served as the bedrock of innovation, yet shortages still remain the foremost challenge that tech companies in GSEA face today.

AppWorks School has trained over 1000 aspiring graduates, serving over 100 prominent companies such as Taiwan Mobile, momo, 91APP, KKBOX, WeMo Scooter, and KKday to meet their digital talent needs. AppWorks School currently provides Coding Bootcamp, Upskill Program and Corporate Training Program with different courses.

More information: school.appworks.tw

Wistron Accelerator

Launched in partnership with AppWorks in 2021, Wistron Accelerator is Taiwan’s leading AI/IoT accelerator program, with the goal of promoting the growth and development of innovative startups through business cooperation and strategic investments. The biannual program hosts up to seven startups each year, working with startups to foster innovation and promote sustainability in strategic industries. In recent years, Wistron has invested over NT$10 billion (>US$300 million) into the digital economy across more than 60 innovative startups.

More information: appworks.tw/wistron

For Inquiries about AppWorks Accelerator, please contact:

Angie Jeng

+886-982-005-566

[email protected]