大東南亞 (GSEA,東協 + 台灣) 最大創業加速器 AppWorks Accelerator (之初加速器) 在今日 (10/15) 舉辦 AppWorks Demo Day 2020。受到 Covid-19 影響,2020 上半年 Demo Day 暫停一次,因此這次的 AppWorks Demo Day 2020,分別從今年上、下半年進駐的 AW#20、AW#21 兩屆新創中,安排 23 支優秀的 AI / IoT 與 Blockchain / Crypto 團隊輪番登台。

23 支團隊中,10 支新創以 AI、5 支以 IoT、8 支以 Blockchain / Crypto 為創業主題。這群未來之星中,有 8 組國際團隊,分別來自香港、新加坡、印尼、瑞典、瓜地馬拉;有出身自 Google、Microsoft、聯發科的高管;有成功被併購出場的連續創業者;還有今年 17 歲,創下 AppWorks Accelerator 歷年紀錄、目前最年輕的創業者。

長期以來,每次的 AppWorks Demo Day,已成為大東南亞新創圈的盛事之一。儘管全球疫情尚未結束,由於台灣防疫的卓越成果,讓 AppWorks 有幸能在台北舉辦大型活動。這次的 Demo Day,採取線上、線下雙軸發表,兼顧交流品質及防疫安全的方式,讓 AW#20、AW#21 新創,都能有更好的機會,展現產品、商業模式以及創業成果,尋求媒合投資人、企業合作夥伴、招募人才、媒體報導的機會。在活動現場,為管控入場人數以及消除疫情風險,採取限定邀請、實名入場制,僅開放給投資人、產業人士,並全程配合防疫措施,另安排線上直播讓所有人士觀看,透過線上觀看的民眾,以及線下入場的專業人士,總人數累計達數千人次,AppWorks 以此盡可能降低疫情對新創團隊的衝擊。

AppWorks Accelerator 目前以 ABS (AI、Blockchain、Southeast Asia) 作為招募新創團隊的三大主軸。誠如 AppWorks 長期以來持續向外界推廣,AI / IoT、Blockchain / Crypto 已成為改變未來的重要典範轉移,AppWorks Accelerator 自 2018 年的 AW#17 起,就鼓勵優秀創業者超前部署,限定招募 AI / IoT、Blockchain / Crypto 兩個領域的新創。此外,AppWorks 也看好東南亞經濟成長,以及數位浪潮帶來的成長紅利,從今年的 AW#21 起,除了原本的 AI 與 Blockchain,再加上面向東南亞市場的新創團隊。

觀察今年的 AW#20、AW#21 兩屆團隊,可發現兩個重要趨勢。第一,由於疫情的發展,加速人類社會的數位轉型腳步,包括遠端工作、零接觸商業模式、去中心化體系,都推升了科技升級的需求,在這當中,為優秀的 AI 以及 Blockchain 創業者,開啟了改變世界的機會之窗。第二,成立邁入第 10 年的 AppWorks Accelerator,校友網路發展蓬勃且區域化,持續扮演支持創業者長期成長的重要平台,因此吸引越來越多國際優秀創業團隊進駐,繼續引領大東南亞地區創業生態前進。

這兩個重要趨勢,展現在進駐團隊的統計數字上。今年 AppWorks Accelerator 在 AW#20 與 AW#21 兩屆,共招募 52 支團隊、82 位創業者進駐,其中 26 支以 AI / IoT 為主、 13 支以 Blockchain / Crypto 為主,以及 13 支佈局東南亞市場的團隊。此外,AW#20 是歷來創業經驗最豐富的一屆,其中 40% 的創業者,已是第二次以上的創業,而 AW#21 則最國際化,66% 的創業者來自台灣以外,橫跨 17 個國家。

潛力新創驚艷登場!

Poseidon Network,企圖用 Blockchain 技術顛覆雲端運算產業

新加坡 Glints,運用 AI 技術打造 HR-Tech 招聘及職業發展平台

來自台灣的 Poseidon Network,是頗受矚目的 Blockchain 新創。創辦人 Light 林弘全 (小光) 擁有豐富創業經驗,包括創辦無名小站、群眾募資網站 flyingV 等。相較於 Amazon、Microsoft、Google 等中心化的雲端服務,Poseidon Network 推動去中心化、可擴展性的 Blockchain 節點服務,透過全世界連網設備裝置中,未被充分使用的頻寬、儲存空間、算力,與 IoT 設備和 5G 電信技術結合,打造霧端節點服務 (Fog Device Service) ,為大眾提供裝置效益最佳化並賺取收益的機會。目前,整體系統涵蓋超過 30 個國家、2,000 個以上的節點,匯聚頻寬超過 1,000 Gbps、儲存空間超過 5 PB,此外,也已與台灣多家合作客戶洽談服務應用對接,讓資源能夠被有效運用,並正在積極拓展東南亞商業合作機會。

來自新加坡的 Glints,是運用 AI 技術的 HR-Tech 新創。2013 年成立的 Glints,是大東南亞 (東協+台灣) 首個結合人才媒合科技的全端 (包含跨國團隊、遠距工作) 招聘及職業發展平台,目標拓展台灣、香港、印尼和越南等市場,2019 年完成由 Monk’s Hill Ventures 領投的 680 萬美元 B 輪融資。成立至今,Glints 每月發佈超過 4,000 份職缺,累計達 3 萬份職缺、超過 1 00 萬筆的人才履歷資料。

來自台灣的 Steaker,結合 AI 機器人建立新一代全球數位資產管理平台。Steaker 運用 AI 整合多元的投資策略,幫助客戶配置 Crypto 資產,更簡便的創造被動收益。2019 年 9 月創立至今剛滿一年,在封閉測試期間,已發展出超過 10 組資產投資策略、訓練超過 30 個 AI / ML Model、追蹤上百個市場指標,由機器人管理的總資產約 400 萬 USDT、平均 ARR 為 23%,即將開發完整商業模式。

來自新加坡的 Mighty Jaxx,致力針對設計師潮玩與收藏品,打造由 Blockchain 技術驅動的交易平台。Mighty Jaxx 成立於 2012 年,利用 3D 設計,把流行文化的概念融入玩具中,讓收藏者有全新體驗。至今,已與全球數百名藝術家,以及 Marvel、DC、Disney、New Balance、Fox 等國際品牌合作,預計在 2020 年,將可銷售 300 萬件潮玩與收藏品給來自全球超過 60 個國家的收藏者與買家。2019 年,Mighty Jaxx 獲得由 Eight Mercatus 領投的 160 萬美元 Pre-A 輪融資,創辦人 Jackson Aw 則曾在 2018 年獲得 Forbes 30 under 30 Asia。

AI 新創開發多元創新應用!

Astra 運用臉部辨識系統,協助企業管理現場員工

AHEAD Medicine,開發血癌免疫檢測 AI 分析平台

在本屆 Demo Day 登場的團隊中,可以看到 AI 應用蓬勃發展,已深入各產業與垂直領域,出現不少讓人眼睛一亮的創新應用。例如,來自台灣的 Astra,開發臉部辨識解決方案,協助大型企業管理遠端及現場員工,今年 4 月服務正式上線,在沒有投放廣告、尚未落地拓展的情況下,就已累計近 3,000 名員工用戶,主要來自日本與印尼,重要企業客戶包括日本電信公司 NTT 東日本、物業管理公司合同產業株式會社 (Godo Sangyo),以及印尼的大型賣場 Pondok Indah 等,都是擁有數千名現場員工的大企業。

同樣來自台灣的 AHEAD Medicine,開發血癌免疫檢測 AI 分析平台。能將血癌檢測的時間,從原本的 7 至 14 天,大幅縮短至檢測當天就能得知結果,降低病患與親友在等待報告期間的心理煎熬,也可爭取寶貴的醫療黃金期,創辦人 Andrea 王毓棻曾有癌症病史,將人生經歷轉換為創業動力,目前合作單位包括 UMPC (匹茲堡大學醫學中心) 以及台大醫學院;Dance Clout 致力打造舞者社群,用戶可上傳自己的跳舞影片,以 AI 骨幹分析和專業老師的舞蹈影片比對動作是否正確,創業團隊僅 17 歲,曾參加建中熱舞社,是正在就讀建中科學班的高中生,滿滿的年輕創業者能量,讓人印象深刻。

在 IoT 領域,本次 Demo Day 登場的團隊,創業成果也不遑多讓。台灣的 iAuto,開發自駕車解決方案,曾參加「2018-2019 杜拜全球自駕運輸挑戰賽」,在新創組脫穎而出,獲得第二名的佳績,並與台灣大哥大、台塑汽車貨運合作,結合 5G 網路,開發將在長庚養生村內落地運作的自駕車系統,是台灣新創與貨車運輸產業龍頭、電信業跨領域合作,發展工商應用自駕車的首例。另外,Aiello 打造的 AI 語音 SaaS 平台,可應用在旅宿、餐飲與旅遊等服務業的後台管理系統和線上數位語音服務;dp smart 成功開發出 6 顆 4K 鏡頭、360° 全景 VR,可一鍵直播的攝影機;WASAI Technology 專注在晶片設計,打造出可運用在 DNA 分析的高速 AI 晶片;來自新加坡的 Cognicept,則提供 SaaS 平台,可遠端即時輔助運行失敗的機器人,協助企業加速機器人實用落地以及 AI 化訓練。

將 AI 運用在教學與學習,提升每一位學習者的成效,是未來重要趨勢,在這次的 Demo Day 上,也有多支團隊以此為創業主題。例如,來自瓜地馬拉的 TUTEEMI,提供不同學習需求的外語家教媒合服務,創辦人 Camila Sáenz,前後共獲得台灣 9 年的獎學金,一路從大學唸到博士班,長期感受到台灣美好的人事物,希望能透過創業回饋台灣,在台灣邁向國際化、雙語化的過程中貢獻價值。來自台灣的 Tera Thinker,運用教育 Big Data 分析,建立自適應學習系統;來自香港的 Sparksine,則開發新一代中文書籍閱聽服務。

Blockchain 新創推動豐富落地應用!

Lootex 運用 NFT 技術,開發數位資產解決方案

Turing Certs 運用 Blockchain 進行學歷認證

除了 AI 領域外,Blockchain 是 AppWorks Accelerator 另一個重要主題。在這次的 Demo Day 中,有多支創業成果豐碩的 Blockchain 台灣新創登台,企圖創造更多元、更蓬勃的 Blockchain 應用場域。FULY.AI 開發投資策略機器⼈,提供投資人針對 Crypto 交易所 Bitfinex 的最佳即時利率⾃動放款服務;Lootex 運用 NFT (非同質化代幣) 技術,針對文創、遊戲、IP 等產業,提供開發 Blockchain 數位資產 (遊戲虛寶、數位收藏品) 的解決方案,目前,由 Lootex 所打造的商城,已有 11 家品牌進駐,知名客戶如電影<聖人大盜>將電影主角做成遊戲卡牌,創造票房以外的新營收來源;Pelith 致力打造 Blockchain 以及 DeFi (去中心化金融) 的解決方案及生態系,2018 年 8 月成立至今,已開發完成多個自營運產品及服務,近期最受矚目的,是成功推出 Hakka Finance,包括建立穩定幣交換平台 BlackHoleSwap、啟動三個流動性挖礦資金池;TuringCerts 運用 Blockchain 開發學歷認證解決方案,企圖降低企業與機構在學歷稽核的時間與成本,目前已獲得加州大學柏克萊分校、台大、清大、交大等大學全校或部分學院採用,並與新竹、中部、南部科學園區等單位合作。

疫情下展現創業韌性,AppWorks 生態系成長遠超越過往

從這次 Demo Day 登台的新創身上,可看出儘管遭逢疫情亂流,創業者們卻展現出強勁的韌性,將危機化為成長的契機。這樣的特質,也展現在 AppWorks 生態系的所有創業者身上。

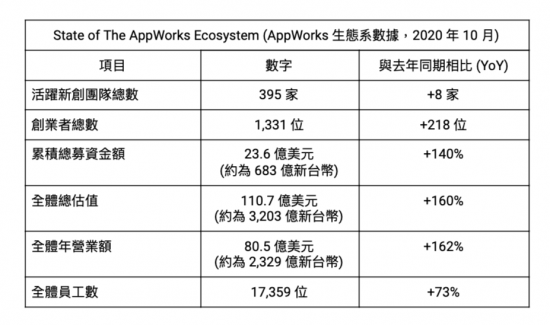

AppWorks 從 2010 年正式啟動 AppWorks Accelerator,今年適逢 10 週年,整體生態系展現出遠超越過往的成長速度。不僅在總募資金額、總估值、整體年營業額都繳出三位數、成長一倍以上的佳績,皆是歷年之最,總估值也寫下突破百億美元的重要里程碑。具體成績包括:活躍新創累積至 395 家、共 1,331 位創業者,所有新創的加總年營業額來到 80.5 億美元 (約為 2,329 億新台幣),較去年同期大幅成長 162%,員工數 17,359 位,年增達 73%,生態系累積募資金額來到 23.6 億美元 (約為 683 億新台幣),年增率高達 140%,總估值達到 110.7 億美元 (約為 3,203 億新台幣),首度突破百億美元大關,較去年此時增加 160%。

對從 30 歲出頭進入 40 代,投入人生黃金十年創辦 AppWorks,陪著所有 AppWorks 創業者一路走來的 AppWorks 董事長暨合夥人林之晨來說,這是所有創業者一起努力寫下的新頁。他感性指出:「創業沒有奇蹟,只有累積。在全球疫情肆虐下,AppWorks 生態系全體能一起繳出這樣的成績,更顯難能可貴。回顧過去十年,AppWorks 與我們輔導的創業者,長期維持二十哩行軍的紀律,從混亂中尋找機會,在變動中保持成長。如今,這個巨大的飛輪已進入高速運轉期,期許未來能加速串連台灣與東南亞的社群,一起打造大東南亞數位經濟共榮圈。」

延伸閱讀:AppWorks Demo Day 2020 登場團隊介紹

【歡迎所有 AI / IoT、Blockchain / Crypto、面向東南亞市場的創業者,加入專為你們服務的 AppWorks Accelerator】

關於 AppWorks 之初創投

2009 年成立,由「創業者」為「創業者」設立的創投與新創社群。致力在大東南亞地區協助下世代的創業者,抓住數位革命的成長機會。正如同 Mobile Internet 帶來了巨變,我們相信 AI 與 Blockchain 是今日的重要典範轉移。我們認為,創造一個偉大事業的過程中,團隊是主角,而投資人則是配角,我們專注扮演配角,從種子時期開始支持有想法的團隊,一路陪著他們打造區域級、世界級的偉大企業。AppWorks 目前共提供 Accelerator、Funds 與 School 等三項主要服務。更多資訊:appworks.tw

關於 AppWorks Accelerator 之初加速器

2010 年成立,現為大東南亞地區最具規模的創業加速器,每半年嚴選本區域最具潛力的新創團隊進駐。輔導新創團隊尋找 Product-Market Fit、幫助成長期團隊建立 Sustainable / Scalable Business Models。成立以來,從 AppWorks Accelerator 畢業的活躍新創已達 395 家、1,331 位創業者,串連成大東南亞最大的新創生態系。過去一年來,AppWorks Ecosystem 大幅成長,所有企業加總營業額達 80.5 億美元,年增 162%,員工數 17,359 位,年增 73%;生態系累積募資金額達 23.6 億美元,年增 140%,總估值則達到 110.7 億美元,年成長高達 160%。更多資訊:appworks.tw/accelerator

關於 AppWorks Funds 之初創投基金

AppWorks 管理三支創投基金共 1.7 億美元,我們與認同我們理念的投資人合作,其中包括在科技製造、金融、媒體等業界領先的龍頭企業。我們每年進行 10 到 15 個投資案,目前為止已投資 55 家新創,其中許多在 GSEA 居於領先地位,如:91APP、KKday、ShopBack、Carousell、iChef 等,此外,Uber、隆中網絡 (6542.tw)、創業家兄弟 (8477.tw)、松果購物 (6740.tw) 也已順利 IPO。更多資訊:appworks.tw/investments

關於 AppWorks School 之初學校

AppWorks School 成立於 2016 年,致力協助渴望投身數位、網路與電商產業的人才,提供免費、實作、高效、與業界結合的紮實培訓計畫。成立至今,已畢業 256 位學員,其中 90% 成功轉職,在 91APP、KKBox、Line TV、WeMo Scooter、Gogoro 等知名新創與科技公司擔任軟體工程師。現經營有 iOS、Android、Front-End 與 Back-End 等專班。更多資訊:school.appworks.tw