AppWorks, a leading startup accelerator and VC firm headquartered in Taiwan, has signed an MOU with Korea Venture Investment Corporation (KVIC) to strengthen support for Korean startups. With KVIC’s strategic commitment into AppWorks Fund IV, AppWorks and KVIC will work together to help Korean founders access new markets, capital, and networks across Asia—empowering them to scale beyond Korea and compete on the global stage.

AppWorks is launching a Korean cohort to accelerate cross-border expansion

AppWorks Accelerator—the renowned startup accelerator originated in Taiwan and has since expanded across Asia—has built its alumni network the region’s largest founder community of 624 active startups and 2,029 founders, and will soon launch a Korean cohort for growth-stage startups ready to expand beyond their home market. Admitted startups will gain access to AppWorks’ valuable mentorship and connection to key strategic partners—including leading regional VCs and top-tier corporates from key sectors such as telecom, world-class electronics manufacturers driving the AI supply chain, cutting-edge media companies, and leading retail players to fast-track their entry into Taiwan, Southeast Asia, and beyond. More importantly, they will join AppWorks’ alumni network across Asia, pioneering frontier technologies such as AI and IoT, while connecting with the corporate partners to accelerate growth and collaboration.

AppWorks connects Korean founders to one of Asia’s most vibrant startup ecosystems and network for capital & strategic partnership.

Founded by one of Taiwan’s most successful and influential founder-turned-investors, Jamie Lin, in 2009, AppWorks has since built a thriving pan-Asia community of 2,029 founders and 624 active startups, all together valued at $32.1 billion and pulling $16.3 billion in annual revenues. These companies span across diverse tech sectors. Built by founders, for founders, this community thrives on peer learning, shared networks, and collaboration. By joining, Korean founders gain a platform to scale beyond their home market and accelerate their path from local champions to regional leaders.

Taiwan is a strategic market, profitability center, and AI hub for startups

Taiwan is quickly becoming a leading hub for AI, with strong ties to the world’s semiconductor supply chain and a growing network of AI startups and corporates. AppWorks connects founders to key industry players and corporates eager to adopt AI and IoT solutions. For Korean startups in AI, Taiwan provides exceptional access to advanced technology and a rapidly expanding market, offering a solid base to grow regionally and globally.

In addition to its strategic position within the AI supply chain, Taiwan is also an ideal market for consumer-facing startups. With strong purchasing power supported by a high GDP per capita of US$34K, and a digitally savvy population eager to try new products, Taiwan serves as both a testbed and a profitability center, where startups can refine their business models and unit economics before scaling to larger markets.

Global players have already proven Taiwan’s strategic value. Coupang selected Taiwan as one of its first overseas markets, quickly gaining traction due to high average order value, dense urban populations, and strong local demand for Korean products in beauty, F&B, and fashion. LINE has built Taiwan into one of its strongest markets outside Japan, reaching nearly the entire population with over 20 million active users. Today, LINE operates as a true super-app, offering messaging, payments, banking, and media services woven into everyday life.

For Korean founders, Taiwan offers both the accessibility of a nearby market and the growth potential of a leading AI ecosystem, making it a powerful bridge from Korea to the broader Southeast Asian region.

AppWorks is doubling down on Korea’s fast-growing tech ecosystem

In recent years, AppWorks has steadily nurtured a growing community of Korean founders, backing ambitious startups and supporting their growth beyond domestic borders. With partnership with KVIC, AppWorks is doubling down—providing Korean entrepreneurs with the networks, capital, and regional know-how they need to scale across Asia.

AppWorks, a leading regional VC with a proven investment track record

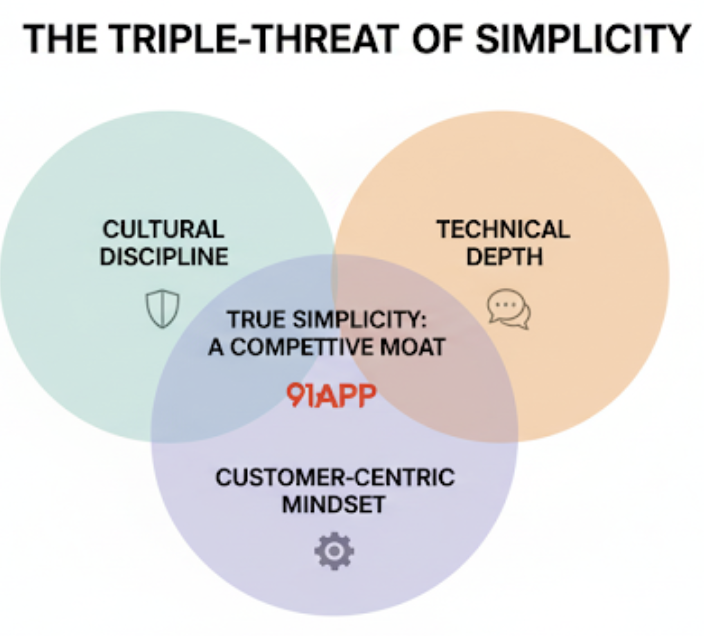

Alongside its accelerator, AppWorks manages four venture capital funds with US$370M total funds raised, investing from seed to Series C stage startups. AppWorks has invested in more than 100 companies, including category leaders such as Lalamove, Carousell, ShopBack, KKday, 91APP, 17LIVE, Animoca Brands, and Dapper Labs/Flow. Its portfolio has produced 6 IPOs, 8 IEOs, 1 hectocorn, 2 decacorns, and 8 unicorns—cementing AppWorks’ position as one of Asia’s most impactful founder communities and VC platforms.

AppWorks and KVIC, together, share a commitment to helping Korean startups grow into global players

Jessica Liu, Partner leading AppWorks’ initiatives in Korea:

“We are excited to partner with KVIC to empower Korean founders. Korea is home to incredible founders and culture, and with the right networks across Asia, we believe these startups can grow into the next wave of regional and global champions.”