Antony Lee, Communications Master (李欣岳 / 媒體公關總監)

負責媒體與社群溝通相關輔導。加入 AppWorks 前有 18 年媒體經驗,是台灣第一批主跑網路產業的記者,先後任職《數位時代》副總編輯、《Cheers 快樂工作人》資深主編、SmartM 網站總編輯。畢業於交大管科系,長期關注媒體產業變化,熱愛閱讀商業與科技趨勢、企業與人物故事,樂於與人交流分享,期許自己當個「Internet 傳教士」。

2018 年成立的 BSOS 灣谷科技,是台灣在區塊鏈這個典範轉移中的早期參與者之一,成員來自金融及網路產業菁英,專攻供應鏈 FinTech。BSOS 透過提供 Web3 的技術與解決方案,活化供應商與企業客戶間的應收帳款,為供應商提升營運資金的時效和彈性,促進實體資產的數位化及價值流通效率,為產業供應鏈賦能。BSOS 在 2021 年進入企業以太坊聯盟 (EEA) 規格制定工作小組,與全球頂尖開發者共同制定企業區塊鏈標準,也獲得 CB Insights 旗下區塊鏈產業分析平台 Blockdata 評選為「全球區塊鏈 35 家潛力公司」,並在同年申請加入 Wistorn Accelerator 緯創加速器,成為第一屆的校友。

BSOS 是共同創辦人暨執行長 Daniel 黃朝秋再度創業。在創立 BSOS 之前,Daniel 曾擔任 Cheetah Mobile、ASUS 及電商集團軟體產品負責人,並在 2015 年創立 AI 語音通訊新創 OneTalk,後來獲得全球最大第三方輸入法公司 Kika Tech 收購。對於他致力於用區塊鏈技術,顛覆供應鏈 FinTech 的創業旅程,以及參與緯創加速器的收穫,並對往後創業帶來哪些價值,AppWorks 特別採訪 Daniel,將他一路上的心得分享給創業者,以下是重點整理:

Q: 在區塊鏈這個領域,最吸引、最能驅動你創業的原因是什麼?

A: BSOS 是 2018 年成立的,在區塊鏈這個領域,我們創業的時間不敢說很早,但我覺得也不算晚。BSOS 是我第二次創業,在此之前的 2008 到 2018 年約莫十年中,包含創業或是更早的工作經驗,我都在 Internet 領域的相關公司,這段時期,剛好完整經歷了 Mobile Internet 起飛,在 2012 年整體產業進入流量紅利期,然後逐漸紅利消失、邁入成熟這一段週期。2018 年決定再度創業時,我最深刻的感受,就是我們過去那種 Internet 車庫創業的時代已經過去了。

倒也不是說 Mobile Internet 完全沒有機會,而是這個產業太集中化了,它變成是一個資本驅動較多,然後更集中少數科技巨頭的產業。對於沒有太多資源,那種還沒有辦公室,只能先在車庫裡、靠幾台電腦創業的新創,機會已經沒有那麼多。過去做出個小 App,只要有需求、用戶參與度夠高,基本上有許多流量自然成長的方法,很容易做成一個 Business,但這個時機已經過去了。

所以,當我在 2018 年決定再度創業時,就是要去找一個科技巨頭不是那麼容易切入的領域,而區塊鏈、Web3 是當時不錯的選擇。事後也證明,從 2018 年到現在,多數科技巨頭也都想切入區塊鏈、Web3,也不是說真的不行,但在這個領域,這些科技巨頭就失去了過往的統治能力。

另一方面,我前一個創業被併購後,有一段時間在做天使投資人,評估過一些新創的投資機會。那時,就已經看到區塊鏈這個剛冒出頭的典範轉移,開始從哲學面、機制面、技術面去深入研究,那時感覺它不是漸進式、而是跳躍式的創新,在我看來,這才是新一代新創的紅利和機會,所以當時沒有第二個答案,就是在區塊鏈領域再度創業,如果再給我一次機會回到那個時候,我還是會選區塊鏈。

Q: 從 2018 年到現在,雖然市場與大環境有起有落,但整體來說,區塊鏈發展得越來越蓬勃,有越來越多機會浮現,為什麼會選擇專注在供應鏈 FinTech 這個賽道?

A: 我們會把自己的定位再放寬一點,就是要用區塊鏈技術,去解放實體世界資產的流通性,打開我們官網的第一句話,就是「Liquidize Real-World Assets with Blockchain」。區塊鏈最核心的應用,就是拿來做價值交換,不管是比特幣、以太幣或是其他區塊鏈資產,過去幾年來,已經充分驗證了價值交換這件事情,但除了這些,還有更大的一塊是 Real Assets,它在傳統上很多價值是不容易被表彰、創造流通性。

每一個供應鏈上,就有很多這樣的資產,過去的流通性,是沒辦法像區塊鏈一樣,用一套帳本去跟全世界流通,我們希望解決這樣的問題,因為它的量體更大。過去近兩年來,整體加密貨幣資產的市值,在 1.5 到 3 兆美元之間變動,而現在全球光是卡在供應鏈的應收帳款就有 40 兆美元,這還光只是一個 Real Assets 的類別,目前在這個世界上,絕大部分的財富價值,都還鎖在實體中,一部分在 Web1 或 Web2 上,只有極少的比例在 Web3 上流通,一旦這個水龍頭打開,會產生更大的影響,我們預期未來如果能將這些資產映射到 Web3 上去交換、產生流通性,對真實世界的貢獻與價值將非常巨大。

Web3 不是企業數位轉型

Q: 既然稱作供應鏈,某種程度上,它就是一個自成一格、相對封閉的體系,每一個都有很深的 Domain Know-how,如何說服那些擁有自己供應鏈體系的大企業,開始擁抱 Blockchain?大企業為什麼需要用一個新創的 Solution?

A: 對!這也是我們過去四年來,一直在這邊走得跌跌撞撞的原因。後來我們有一個體悟:Web3 的打法,絕對不能用企業數位轉型這個角度來思考,那樣只是把 Web3 的技術,強行套到 Web2 世界的邏輯裡,做到後來還是 Web2 的格局。如果只是要把資訊數位化,其實不需要用到區塊鏈,這樣企業還比較可控、效率更高。

因為 Web2 和 Web3 之間,有中心化和去中心化的差別。我們也曾嘗試參與過 Web2 的企業專案,了解他們有什麼需求,進而用區塊鏈的方式去滿足這樣的需求和系統,實際運作下來,發現這樣是行不通的,因為 Web3 有 Web3 的作法,不該去做數位轉型,而是要做價值交換和流通,這才是核心。

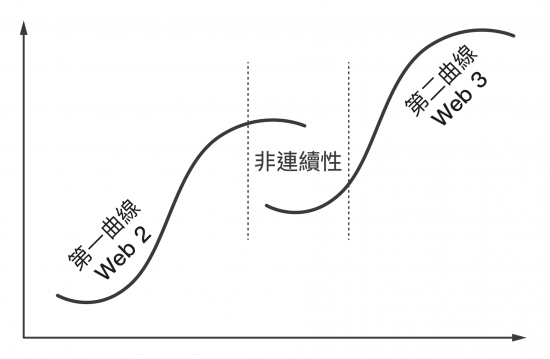

我會從兩條不連續的成長曲線來思考這個問題。如果順著第一曲線走,企業會進行數位轉型、流程優化,最後走到斷點,企業是不可能就到此為止然後跳下懸崖,所以第一曲線的終點,就是 Web2 的天花板。我們行業內常有人開玩笑,區塊鏈一開始不可以跟實體的世界,或是傳統的流程綁得太緊,否則「區塊鏈的應用落地即墜毀」,這個背後是有幾分道理的。

我們認為 Web3 必須從第二曲線的底部開始走,只有當創造的價值,來到超越第一曲線天花板一段距離後,還在第一曲線的人,才會願意放棄原本的做法,直接跳過來,從 Day 1 就按照 Web3 的規則走,也就是不管以前的規則是什麼,就跳過來用 Web3 的規則去做事情,其實很多 DeFi 應用就是這樣的,並沒有去參考銀行怎麼做,不會去了解什麼單子、要什麼欄位,讓彼此串接的資訊格式不要跑掉,直接就跳過採用 Web3 自己的新作法。在這背後,可能會提供參與者更高的資本報酬、打破原本的交易門檻、較少中心化介入的摩擦,甚至提供參與治理的機會,這些都是 Web2 做不到的。

要怎麼走出這一段,是所有 Web3 項目的共同命題,關鍵挑戰在於怎麼維持生態的流通性?很多 Web3 項目靠的是發幣補貼,這方面實體資產就有優勢了。因為它原本就具有實體價值的支撐,但同時也代表,它的資產波動幅度沒那麼劇烈,我們必須透過一些機制,使資產可以分別滿足穩健型和風險型的購買者。所以回到問題,如果要企業擁抱區塊鏈,我認為關鍵還是在經濟模型的設計,從治理層面,直接激勵參與者,因為趨利,自然而然投入生態、做出對生態有益的事。

Q: 如果直接從代表 Web3 的第二曲線出發,呈現在你們 Pipeline 上選擇的供應鏈客戶會長什麼樣子?

A: 根據我們實際走過的經驗,我相信 Web3 這邊的順序,會非常顛覆我們過去做 Web2 的三觀。過去,Web2 企業,要先把應用場景做好,延伸出的價值才可以被流通、才有流通的價值,Web3 則是先有流通性,再利用這個流通性回去創造應用場景。這樣的例子很多,各種 XX to earn 都可算是這個模式,例如,先發 NFT 頭像,再去發展社交的功能,有這個資產的人,就會衝進去玩後來才做的遊戲,然後 Play to earn,參與度會比 Web2 更高,因為他有更多經濟上的動機,這聽起來很顛覆三觀,就是先創造流通性,再從流通性去激勵。

回到供應鏈客戶上,具備數位化到一定程度以上的企業,對我們接受度比較高。因為畢竟是要把實體的資產與區塊鏈串接,它中間需要一個類似 Oracle 的機制,供應商是否有這筆應收帳款,其實就是一個 Oracle,只是會比較複雜一些,需要更多方的確認。

參加緯創加速器,獲得供應鏈管理的 Insight

Q: 歷經了這些創業經驗後,為什麼會在 2021 年、BSOS 創業的第三年決定申請參加緯創加速器?

A: 最主要的原因,是我們希望透過參加緯創加速器這段時間,給自己一個實驗 PoC (Proof of Concept) 的機會,因為這和我們自己去開發客戶很不一樣。自己找的客戶,可能在被拒絕後,因為客套或是其他原因,不會跟我們講真正拒絕的原因,這可能會讓我們走火入魔,因為劃錯重點而要多繞很多路,進而浪費很多時間,這對新創、尤其是區塊鏈的新創,是非常奢侈的浪費,另外,一旦被對方拒絕後,短期內我們也很難再回去拜訪對方,針對被拒絕的原因,追問更多、更深入的問題。

在參與緯創加速器這段期間,就完全不是這樣。他們會跟我們分享更多思考與決策的脈絡、真正的需求是什麼,然後提供滿多的機會,讓我們去重複修正跟提案。若沒有參加加速器,我們很難從緯創這種規模、產業的企業身上,獲得這樣的經驗。比起其他提供給新創的資源,我覺得能獲得這樣的 Insight,是我們參加最大的收穫與價值。

Q: 在供應鏈管理上,可能光是層層往上敲門與提案的過程,就遍體鱗傷了吧?

A; 這過程的確很花時間。我們透過參加緯創加速器,與緯創集團各事業單位媒合,最後是跟緯穎合作。剛開始,我們覺得應該就是派位專員層級的人來與我們對話,但其實是副總經理層級親自參與,這真的是很難得的事情,每次的討論會議,Joe 副總 (緯穎科技副總經理焦裕洲) 都有參加,提供不少 Insight 給我們。

也是因為參加緯創加速器,讓我們驗證了供應鏈應收帳款,這個問題是真的存在。對中小型供應商來講,這些問題要如何被解決,背後有一些脈絡,而我們會有一個比較深層的理解。另一方面,就是要如何創造核心買家、最後要付款的這個人,他可以有哪些動機願意參與,這將是整個系統設計比較大的關鍵,而不是讓效率更高的數位化流程等這些事情。如果再往未來多看一點,其實這就是 Web3 項目得以成功的武器,Web3 最重要的事情,就是創造大家的動機,讓對這個生態系有貢獻、把事情做好的角色,都能從中獲得有形或無形的獎勵。

Q: 以你實際參與緯創加速器的經驗,對於未來也想要申請加入企業垂直加速器的創業者或新創,有哪些提醒或建議?應該有哪些心理準備或期待?

A: 我很鼓勵新創圈的朋友,若技術或服務的應用場景符合、需要進行 PoC,都應該爭取這樣的機會。在心態上,我覺得參與這類企業垂直加速器,不要只是抱著把東西賣給大企業的目的,一定是能從對方的建議與回饋中,找出產品或服務可以調整和優化的地方,實際參加的這段時期,在產品、技術或是商業模式上,要預留可以修改的空間,這和推廣業務非常不一樣。

從這個角度來看,我建議比較適合在成長期的新創申請加入。就是比早期再成熟一些,已經有一個基本且可行性高的產品架構,但還沒有進入太大規模的商業化,產品、技術、商業模式都還有調整的彈性,參加這樣的企業垂直加速器幫助最大,如果產品或商業模式已經很成熟,能更動的地方不多,收穫可能就比較有限。

不同的企業加速器,一定會有不同的做法。以緯創加速器來說,他們對新創算是很尊重,交流與溝通很開放,也不會倚老賣老,會從緯創自身的角度,來跟我們分享為什麼會有這樣子的需求,在這樣開放的溝通下,我們可以互相激盪出新想法,以及深入的產業洞察。

Q: 展望未來,BSOS 下一階段的創業目標是什麼?

A: 我會把創業至今分成三個階段,目前正在第三個階段。第一階段大約是 2018 到 2020 年,我們主要提供技術服務和中間層工具,投入大量資源在聯盟鏈及相關工具的研發,因為許多優秀的人才,我們入選了企業以太坊 (EEA) 的規格制定小組,也是全球唯一同時被三大聯盟鏈 R3、Hyperledger、Consensys Quorum 認定為技術夥伴的公司,這樣的技術力,即便放到國際上,都是領先的。

第二階段大約是 2021 年,我們建立了 Real Assets 的 Oracle,打造出 SUPLEX 這個產品,一端接鏈下系統、一端接區塊鏈智能合約,將實體資產鑄造成鏈上資產。因為我們創業最重要的目標,就是打造一套鏈下資產映射到鏈上的機制,並且創造一套遊戲規則,讓所有參與者都能在做好某件事情後,獲得具體的好處。

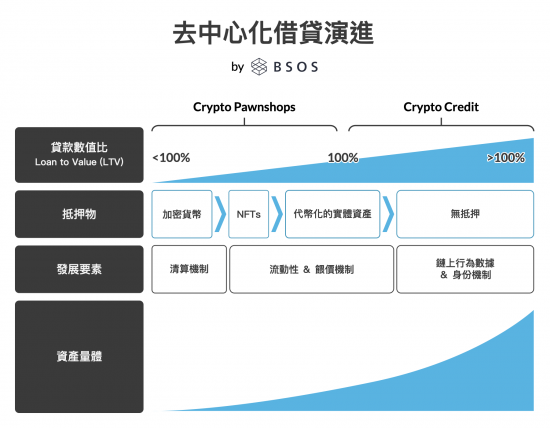

第三階段的目標,則是為生態系建立一套激勵系統,創造源源不絕的流通性。我們思考的還是Web3、DeFi 的方向。從 2020 年 DeFi Summer 到現在,可以看到各種 DeFi 創新百花齊放,但我覺得第一個週期大概已到尾聲了。我們現在看到所有的 DeFi 借貸協議,都是超額抵押的概念,一旦幣價下滑,就是在鏈上被清算掉,回到一個根本問題:如果有 150 元的資產,為什麼要拿去抵押借 100 元?這不是真的缺錢,而是要做資金操作、做槓桿,把借來的錢再投入資本市場去滾錢,它很好,能夠創造流通性、創造一個價值兌換的體系。

但從金融發展史的視角來看,這個模式的概念上比較類似當鋪,還是非常初期的金融模式,宏觀來看,借貸 DeFi 未來還有很大的發展空間。接下來金融的發展,應該是要借錢給真正缺錢的人,或是借錢給要去生產或創造的人,讓這些創造者把這些錢花掉,而不只是到金融市場滾一圈再回來,應該是要在產生實質價值的商品跟服務後,讓這些價值可以再回到區塊鏈的世界。這是我們努力的目標,把錢借給真正需要的人,把錢拿去做生產、創造。Real World DeFi 是 BSOS 的下一個目標,這也是激勵參與者、創造流通性的關鍵機制。國際上已經有一些協議正在萌芽,我們會善用 Web3 的 Money Lego 特性,去展開協議之間的合作與串連。

【歡迎優質 AI、物聯網、雲端、資安、教育與醫療新創加入 Wistron Accelerator】