Jun Wakabayashi, Analyst (若林純 / 分析師)

Jun is an Analyst covering both AppWorks Accelerator and Greater Southeast Asia. Born and bred in America, Jun brings a wealth of international experience to AppWorks. He spent the last several years before joining AppWorks working for Focus Reports, where he conducted sector-based market research and interviewed high-level government leaders and industry executives across the globe. He’s now lived in 7 countries outside US and Taiwan, while traveling to upwards of 50 for leisure, collectively highlighting his unique propensity for cross-cultural immersion and international business. Jun received his Bachelors in Finance from New York University’s Stern School of Business.

As the world came to a standstill from COVID19, the first half of 2020 proved to be a challenging time for industries across the board. With all its promises and potential, even the nascent blockchain industry was not immune to worldwide lockdown and social distancing measures. A handful of established players certainly benefited from the accelerated shift to online consumption and digital living. But, those projects without solid foundations, compelling use cases, and sustainable business models quickly found themselves at the end of their runways.

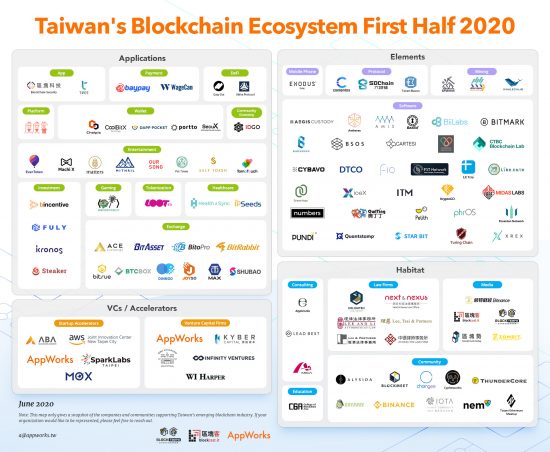

With only 447 confirmed cases and 0 local transmissions in the last two months, Taiwan has garnered worldwide adoration for its handling of the novel coronavirus. The local blockchain industry, however, did not go completely unscathed. Compared to 19H2, 21 projects have since ceased operations and been taken off the map. This is the largest number of removals since AppWorks Accelerator started producing the ecosystem map two years ago. With only 16 additions, there were also a fewer number of new organizations entering the ecosystem compared to any other half. Collectively, there was a total of 112 projects noted on the map, down from 115 in the last update.

2020 is clearly shaping up to be a year of reckoning. Financial markets are in disarray, global supply chains have been crippled, and economies across the globe are struggling with unprecedented productivity loss. That said, if 2008 was any indication, heroes are often born in the midst of a crisis. The pandemic has highlighted glaring efficiency and reliability gaps in our current processes and systems, forcing upon us new ways of working and thinking. “The new normal” may very well serve as the necessary accelerant to convert blockchain’s perception of cautious skepticism into widespread pragmatism, which we’re already starting to see early signals of.

Enterprise adoption picks up

There’s been a lot of talk about how and when to potentially use blockchain. Now, it seems like enterprise adoption is starting to pick up steam. As many of them lack the capabilities in house, we’ve seen several corporates in the last six months announce their latest initiatives in partnership with local blockchain startups.

Taiwan’s leading financial conglomerate with over US$335B AUM Cathay Financial Holdings announced that it’s developing an electric vehicle IoT financing platform in conjunction with EV charging service provide ChargeSmith (AW#16) and supply chain-focused blockchain startup BSOS. The new platform collects and stores EV owners’ driving behavior, which will then be used to provide real-time personalized financial services ranging from insurance to banking products. In another example of enterprise partnerships, longstanding email security provider Openfind unveiled its collaboration with BlockChain Security to launch an intellectual property protection solution, which aims to help enterprises store and transmit confidential information more securely.

It’s no secret that banks have been some of the earliest adopters of blockchain technology in Taiwan, as seen by Cathay and CTBC, the latter of which runs its own blockchain incubator and is a part of international blockchain consortium R3. Taiwan Business Bank was the latest to hop on the bandwagon. They recently unveiled their intentions to implement blockchain technology into the process of issuing confirmation letters in order to lower the risk of falsification.

Meanwhile, crypto asset management platform Bincentive recently disclosed its partnership with Japan-based Rakuten. Users of the international e-commerce site will now be able to purchase crypto investments using their loyalty points. Along the same lines, BitoEx (AW#6) which operates one of Taiwan’s largest crypto exchanges now allows FamilyMart members to redeem their loyalty points for bitcoin purchases.

Thus far, Tawianese corporations are clearly displaying a positive embrace of blockchain technology. However, due to their traditional management structure, implementation of the technology is still veered towards a centralized model, inhibiting some of the touted benefits of blockchain such as autonomy, no single point of failure, and overall the democratization of data and authority. Moving forward, it’ll be worth observing how enterprises might adjust their cultures and governance models as decentralization increasingly transitions from fringe to mainstream adoption.

The new normal

Blockchain has been in development for well over a decade now, and the crypto market has correspondingly undergone its fair share of cycles. In the process, investors have become increasingly more sophisticated in terms of their understanding and approach to the market, as well as the instruments and structures they use to finance deals. Nevertheless, crippled economies across the globe have led investors to reel back their money for the time being, allocating their attention to existing portfolios or waiting for brighter horizons.

With the current circumstances, the development of early stage startups has become polarized. The market will be unrelenting for those relying on projects to generate ad hoc cash flow, as the downturn has caused a tightening of the belt for customers across the board. On the other hand, those teams that have found product-market fit and solve a real world pain point for clients at scale will have greater commercial prospects, ultimately contributing to a stronger and more sustainable ecosystem that’s driven by a project’s actual value rather than market hype and speculation.

There were a few bold blockchain entrepreneurs, for example, with innovative technology and solid business models that were highly favored by investors. CoolBitX successfully closed a US$16.75M series B round of financing, led by SBI Holdings. The newly raised funds will be used to continue development and rollout of its messaging-based KYC/AML solution for virtual asset providers. In addition, BSOS also completed a million-dollar seed round in the first half of 2020—including NT$20M (US$678K) from Taiwan’s National Development Fund—to advance its blockchain-based supply chain financing solution for enterprises.

Digitalization vs decentralization

Looking back in the first half of 2020, it was a rather harrowing time for the blockchain industry. Right at the onset of COVID19 in March, cryptocurrency prices dropped by 40%. A few months later in May, Telegram—which in 2018 raised the second largest ICO in history at US$1.7B— announced the suspension of its blockchain project the Telegram Open Network (TON) shortly after the SEC won a preliminary injunction, citing a plausible case that Telegram had sold unregistered securities in its coin offering.

Crypto prices have since more or less recovered to pre-COVID19 levels, especially as people increasingly sought out alternative stores of value like bitcoin as a hedge against inflationary currencies. The halving of bitcoin this past May and the added supply scarcity will likely continue to drive up its value, as it’s done so consistently in the past. Since TON was officially abandoned, there have been many communities around the globe that have been rallying to keep it alive, including the Chinese TON community which claimed that it would launch its own version of the blockchain.

At this point, what are the next growth opportunities for blockchain? Everyone has different interpretations and expectations. However, currently, conversations are mostly centered around the pandemic, with criticisms mainly targeted at the limitations and failures of centralization. Whether it’s in terms of tracing vaccination records, tracking medical supplies, eliminating fake news, or disbursing economic aid, decentralization has been thrown in as a prominent solution to many use cases. However, as impactful as these use cases may be, the reality is that boilerplate digitalization is still higher on the pecking order for most people. The age of remote work catapulted people into a new normal, forcing everyone to figure out how to do everything over the worldwide web, from basic necessities like ordering food or groceries to lifestyle needs like exercise and socialization to work needs like conducting meetings or business presentations.

Digitalization and decentralization are not mutually exclusive, however. If anything they are complementary. Novel thinking often calls for novel solutions. Decentralization can provide the perfect combination of efficiency, transparency, and autonomy that people didn’t even know they wanted or needed. For now, aside from decentralized finance (DeFi), games and entertainment-related services will likely dominate the majority of use cases, both of which benefited tremendously from the pandemic in terms of adoption and usage.

Existing entrepreneurs in this space would be wise to continue building their experience in this area, acquiring users, and strengthening their positioning. For aspiring entrepreneurs, realize that the world has hit reset and undergone a rude awakening; consequently, there’s never been a better time to explore and introduce radical new ideas.

Taiwan’s Blockchain Ecosystem Map First Half 2020 is produced by AppWorks and updated every six months. If you have any comments or suggestions, please send us an email at [email protected].

【If you are a founder working on a startup in SEA, or working with AI / Blockchain, apply to AppWorks Accelerator to join the largest founder community in Greater Southeast Asia.】

Photo by Robert Pastryk on Pixabay