Ronnie Tseng, Business & Product Development Master (曾亭瑞 / 事業產品開發經理)

Before joining Team AppWorks, Ronnie was a Co-founder of iBeengo, an AppWorks #4 startup and successfully launched two online travel services, DingTaxi.com and AirPoPo. As a full-stack engineer, Ronnie wrote the codes of the MVPs and directed the web development team. In addition, during his time working at Taiwan Mobile, Ronnie successfully led a major revamp of the telecom’s mobile app, receiving exceptional user ratings from a base of over 1 million MAUs. Ronnie holds a Bachelor of Computer Engineering from University of British Columbia and worked abroad in Japan for seven years, where he also received an MBA degree from Nihon University. Ronnie has a passion for surfing and has watched countless sunrises from the shores of Taiwan.

(English Below) 人生有兩件事情讓我找回了自信——創業與衝浪。

小時候在台灣接受填鴨式教育,補習補出一身會考試的好功夫。但到了加拿大的大學讀電子工程,卻無用武之地。考試答案不在教科書裡、Project 如何完成也沒有製作手冊。電路板不會畫,只好拜託那位從小視修電腦主機板為樂趣的同學跟我同一組。Compiler 不會寫,只能「參考」從小就會寫 COBOL 那位同學的程式碼。

挫折的壓力,導致我大三的時候得了胃潰瘍,身心都疲憊,只想快點畢業,不要再碰任何電腦相關的工作。畢業後,有別於其他同學回台灣,或到北美的科技公司任職,我做出一個很奇妙的選擇:去了日本。在日本這動漫國度待了七年,收穫很多,但遠不及我後來更奇妙的選擇——我去創業了!

2010 年,一次家族旅行啟發了我們 (滿腦子想創業的弟弟、滿腦子想賺錢的我),發覺自助旅遊有許多環節可以被網路科技改善。 2011 年 12 月,我們兩人以 iBeengo 團隊加入了 AppWorks Accelerator #4。當時我對於寫 Code 興趣缺缺,單純想當個 PM,把網站開發外包出去。結果,接案工程師一個月後突然已讀不回、搞失蹤。眼見 Demo Day 即將來臨,我拋開寫 Code 的自卑,急迫買了幾本 For Dummies 教科書,閉關在 6 坪大的南港小公寓,從零開始開發。好險趕上了 Demo Day,看著弟弟在台上 Demo 我做出來的行程規劃網站,那一刻的我充滿了成就感。由於過去沒有旅遊產業的經驗,我們一直 Pivot 尋找 PMF,試著在不同旅遊業區塊找商機——我開發過民宿網、Walking Tour 活動網、DingTaxi 包車網,以及 AirPoPo 機場接送共乘 App。這 10 年的創業時光,累積的作品及成果,可說是我工程人生的高潮。

我一度找回了自信。

But!是的,But 來了。下的浪越高,快感越大,但能力不夠,最終會被白浪花給推倒。

2020 年,COVID 導致公司營收瞬間歸零。此前公司已經面臨成長瓶頸,突如其來的打擊,也來不及找出突破點,只好選擇結束營業。公司收掉後,腦子整天回放過去的錯誤決策,覺得都是自己能力不夠。我陷入了自我質疑、自我責備的漩渦。

好險,我身邊有張衝浪板可以救命。

早晨 4:30 起床、5:30 下水看日出、7:30 上岸、9 點準時變身為白領上班族。一週衝兩次,好浪可遇不可求。每天看浪況預報,自問「有浪嗎?」能衝到好浪,整天工作都很愉快。漸漸學會選好的浪點、學會挑好的浪,也學會如何釋懷。

「這一道沒衝到,再等就有。」

「浪太大,出不去。下次再來。」

「沒浪,那就划划水。運動運動。」

自信又重建回來了。給自己一個小確幸,每個月固定去台東衝浪聖地朝聖。在那認識了幾位衝浪前輩,啟發我對於衝浪更大的熱情。從衝浪的穿搭、衝浪板的選擇、衝浪技巧、秘密浪點位置等等,都有很大的學問可以鑽研。

回顧過去,創業 10 年讓我得到做產品的自信,創業的失敗讓我一度自我懷疑,在衝浪前輩的鼓勵下,我又在此重建了人生的信心。現在我相信自己的經歷不是浪費,只是一直在等更好的浪,所以我今年決定加入 AppWorks,想把自己的血淚與人生,貢獻給熱血的創業者,我也跟你們一樣經歷過這些起伏,尤其草創階段更像變幻莫測的海浪。

我是新上任的產品與商務開發 Master、退役的創業者。草創階段的大大小小問題,幾乎都碰過,很樂意與你聊聊。

In my life’s journey, there are two things that brought my confidence back, building a startup and surfing.

When I was growing up, I was told to go to cram schools, and focus on getting good grades. However, when I got into a Canadian university to study Computer Engineering, the academic scene was totally different than what I expected. The textbooks didn’t have all the answers for the tests. The project assignments didn’t come with instruction manuals. I didn’t know how to design a circuit or program a compiler, so I had to team up with classmates who grew up fixing motherboards or programming in COBOL. I never needed to rely on another person to get good grades before. During my third year, as I struggled academically and felt the intense pressure of my studies, I suffered from a stomach ulcer. By then, all I cared about was quickly graduating, and wanted to never touch any computer-related work again. After graduation, my colleagues all found engineering jobs in Taiwan or in North America. However, without too much thought, I chose an unusual path and went to work abroad in Japan, aiming to master the Japanese language and watch anime without subtitles. My seven years in Japan went smoothly, and led me to start my own company.

In 2010, during a family retreat, my brother told me he wanted to build a startup. So, we brainstormed about what sort of business ideas we could try, dreaming that we could build a Facebook- or Google-caliber company. During the trip, we noticed that planning a roadtrip is such a hassle, and many aspects of travel can be improved by using technology. In December 2011, we were accepted into AppWorks #4, as iBeengo, an online travel startup. At that time, I still disliked programming, and preferred to outsource web development to a freelancer. However, after one month of communicating our product requirements, the freelance programmer suddenly went dark and could not be reached. Seeing that AppWorks Demo Day was just around the corner, I was so exasperated that I surrendered my reluctance, bought some web development books for dummies, locked myself in a tiny apartment, and built everything from scratch. The work paid off, and the iBeengo trip planning website was ready to be presented on Demo Day, but that was just the beginning. Since we didn’t have prior work experience in the travel business, iBeengo pivoted a few times, testing out different travel segments, and trying to find product-market-fit. I built an online BnB booking website, a walking-tour event website, an online charter-service booking website called DingTaxi, and an airport ride-sharing mobile app, AirPoPo. During these ten years of running a startup and building these products, I gained back my confidence through these small accomplishments.

But, yes, there is always a But.

The bigger the wave, the more exhilarating to take off, but for those who lack skill, one will end up in the white water. In 2020, being hit by the COVID pandemic and global travel ban, my company’s revenue dropped to zero instantly. Not long before, iBeengo had already struggled to grow and couldn’t find a breakthrough, so we decided to close iBeengo. For quite some time, I viewed this event as a personal failure caused by my lack of ability and poor decision making. I immersed myself in a pool of self-doubt and self-blame, but luckily, I had a surfboard aside to keep me afloat.

4:30AM Wake up, 5:30AM in the water watching the sunrise, 7:30AM out of the water, 9:00AM arrive in the office. This is my typical routine twice a week. Everyday, I check the wave forecast and ask myself if there will be good waves tomorrow. If I have a good surf session, the rest of the day is a bliss. Session by session, I became better in predicting swells, better in surfing, and better at letting go.

“If I didn’t catch a wave, just wait for the next one.”

“If the swell is too big to paddle out, then maybe next time.”

“If there are no waves, then let’s just paddle for exercise.”

Eventually, I rebuilt my confidence.

Nowadays, I would treat myself to Taiwan’s best surf destination, Taitong, once a month.

Over there, I can relax and mingle with other passionate surfers and learn more about surfing, from surfboards, surfing techniques, apparels, to secret surf spots. It’s like a sanctum to me.

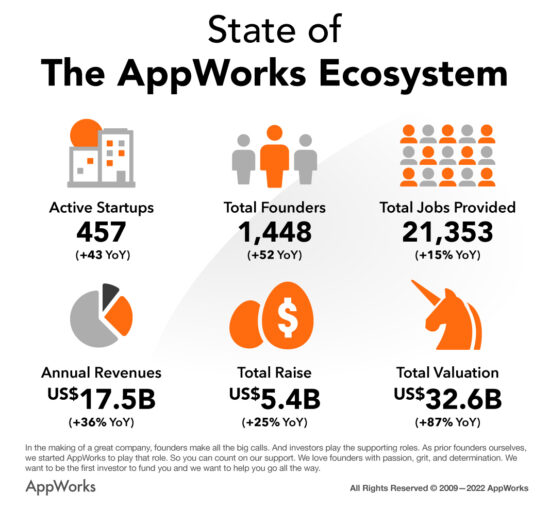

AppWorks, too, is like a sanctum, but for entrepreneurs.

AppWorks has a community of startup founders, and mentors that are passionate about making better products and changing the world bit by bit. The path of building a startup can be full of hurdles and hardship, but here at AppWorks, you can seek guidance or resources or be motivated by the network of founders and mentors. I encourage you to check us out.

I am the newly onboarded Business & Product Development Master of AppWorks. If you need someone to brainstorm about a product idea or a solution to an early-stage startup problem, feel free to reach out to me anytime.