Ching is a Principal leading the Web3 Arm at AppWorks. Ching interned at AppWorks when she was in college and returned as an Analyst after earning her B.B.A from National Chengchi University in 2015. Her keystone achievement as an Analyst was helping CHOCO TV’s journey from Series A to an eventual acquisition by LINE. Ching became our Associate in 2019, spearheading our foray into the blockchain industry by recruiting founders active in the space and effectively jumpstarting our web3 ecosystem, which has since grown into a thriving community. She’s also helped AppWorks participate in several prominent investments, including Dapper Labs / Flow, and Animoca Brands. Ching was promoted to Principal in 2022. Off the clock, she likes to experience new things, travel, and play tennis.

We are thrilled to announce our investment in Marcelo Ruiz de Olano, the visionary CEO of karpatkey, who is redefining treasury management in DeFi. By providing non-custodial treasury management solutions and infrastructure, karpatkey has already garnered the trust of major DeFi protocols like AAVE, Uniswap, and Balancer. Here’s why we decided to back Marcelo and his exceptional team.

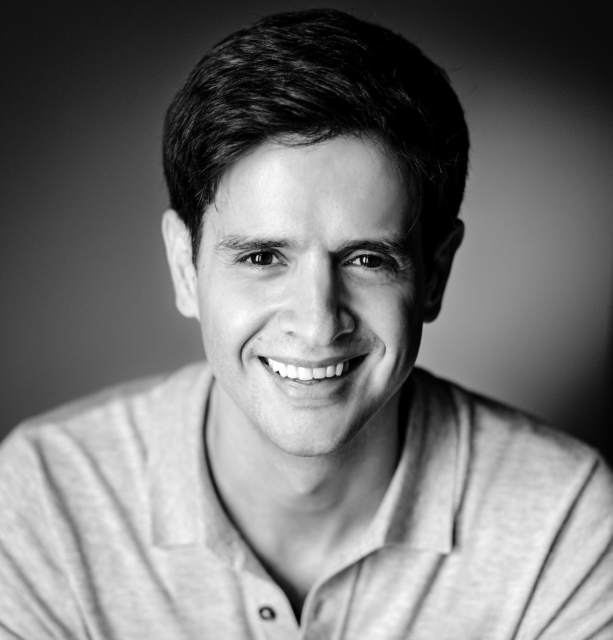

Marcelo Ruiz de Olano: A Visionary with a Story of Resilience and Innovation

At AppWorks, we seek founders with the vision, determination, and execution ability to address critical challenges in their fields. Marcelo Ruiz de Olano not only possesses these traits but his deep expertise in both finance and decentralized systems makes him uniquely qualified to revolutionize treasury management in decentralized finance (DeFi). His ability to navigate complex financial environments and his commitment to building transparent, secure solutions have positioned him as a transformative leader in this space.

Marcelo’s journey is a testament to resilience and adaptability. Born in Buenos Aires, Argentina, he often felt like an outsider, fueling his desire to seek new opportunities and a sense of belonging beyond his home country. During college, Marcelo longed to participate in an exchange program to explore life outside Argentina, but his parents refused to support him, dismissing it as a desire to party abroad. Determined, he found a way to finance himself and moved to Spain to fulfill his ambition.

However, the aftermath of the 2008 financial crisis made opportunities scarce. Without any financial backing from his family or the government, Marcelo faced tough challenges and was on the verge of proving his parents’ doubts right. Yet, he persevered, supporting himself through the economic downturn and overcoming the cultural differences between Argentina and Spain, despite the shared language

Upon returning to Argentina, Marcelo joined Chevron, where he refined his decision-making skills and financial modeling on major capital projects exceeding $100 million. This role significantly deepened his understanding of global finance. By the age of 28, Marcelo had mastered the art of arbitraging stocks, bonds, and commodities, generating enough cash flow to achieve financial independence. He left the corporate world to travel and explore new opportunities. His journey eventually led him to cryptocurrency during the 2017 boom. The subsequent ICO bust became a pivotal moment, solidifying his belief in the transformative potential of decentralized finance.

Under Marcelo’s leadership, assets within karpatkey’s DeFi treasury network have skyrocketed from $300 million to over $1.8 billion in less than 3 years. His vision of creating a non-custodial, transparent treasury management system earned the trust of industry giants like Uniswap and AAVE. Marcelo’s personal and professional journey is a testament to his relentless drive to innovate and lead in the world of decentralized finance.

karpatkey: Empowering DeFi with Transparent, Non-Custodial Treasury Management and Advanced Automation Tools.

karpatkey has quickly established itself as a leader in DeFi treasury management, transforming how top organizations manage their financial assets. Originally formed in 2020 to manage the Gnosis treasury, karpatkey has since expanded its services to provide sophisticated financial solutions for renowned DeFi protocols such as AAVE, Balancer, and ENS.

karpatkey is trusted by the DeFi community due to its commitment to transparency and security. The company’s non-custodial approach allows DAOs to retain full control over their assets—a critical feature in today’s trust-driven ecosystem. karpatkey also offers advanced automation tools for risk management, ensuring that clients’ assets are managed with precision and care.

karpatkey: Redefining Finance with Innovative DeFi Solutions and Seamless Institutional Access.

karpatkey’s future vision includes expanding its product suite to serve both the DeFi and traditional finance sectors. One of the upcoming initiatives is the launch of actively managed open-ended funds, designed to give institutional investors access to blue-chip DeFi tokens and yield-generating opportunities.

karpatkey is also preparing to introduce a DeFi Exchange Traded Fund (ETF), providing institutional investors with a secure and regulated gateway to DeFi yields. This marks a significant step toward bridging traditional finance with DeFi, reinforcing karpatkey’s role as a pioneer in decentralized financial management.

Join Us in Shaping the Future of DeFi

If you are a DeFi founder or project looking to collaborate, we invite you to explore potential synergies with karpatkey and the AppWorks community. Together, we can build a stronger, more resilient DeFi ecosystem that is ready to redefine the future of finance.