We are delighted to share that AppWorks has invested in $CLOUD, the native token of Sanctum, as a demonstration of our long-term belief in Sanctum’s founding team and in the strong defensibility and moat they’ve built over the years.

Below, we will share why we think Sanctum is one of the most important companies being built on Solana; how it is reshaping one of the most misunderstood verticals in crypto, and why everything is finally clicking for them.

Sanctum – A Chronicle of Finding the Non Consensus and Right

To understand Sanctum, we need to first understand the history of Solana LST.

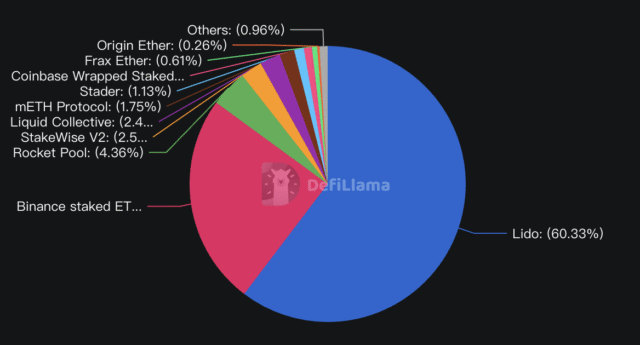

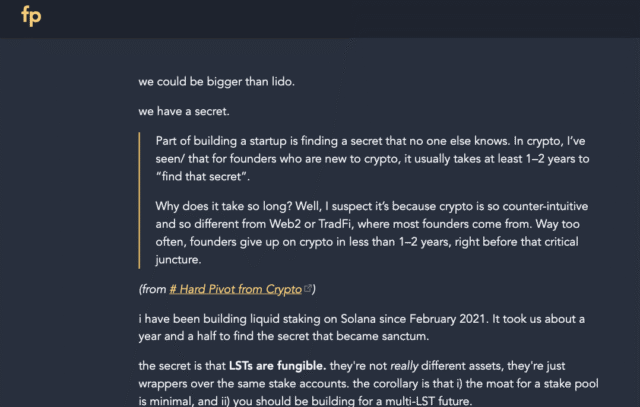

For the longest time, most people assumed Solana’s liquid staking market would follow the Ethereum playbook: one dominant player, i.e. Lido, and everyone else fading into the background. Many protocols rushed to build copycats of the Lido model, believing the game was simply about scale and validator sets.

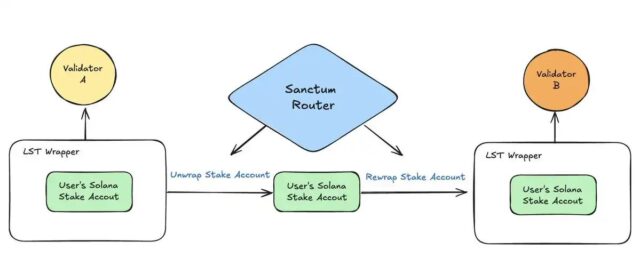

The most insightful founders see what others miss. FP Lee, Sanctum’s founder, being the core contributor who has designed Solana’s stake account contracts, knew early on that Solana’s setup is fundamentally different from Ethereum’s. Every stake account is modular, transferable, and composable. That means all LSTs on Solana are essentially fungible at their core. They are just wrappers of the same underlying stake accounts.

With that realization, the next question was obvious: in a world of many LSTs, what’s the missing primitive?

Look closely, stake pools serve three distinct purposes:

- Tokenize – convert native stake accounts into yield bearing SPL token

- Delegate – achieve high staking yield and decentralize the network

- Liquidate – Provide instant liquidity for staked SOL

And FP bet on liquidity.

Why? Because Ethereum already ran the experiment. Lido dominated Ethereum largely because stETH is integrated into all major DeFi protocols and has extremely high composability. Years of integrations made it the most composable asset on the network, and distribution compounded into dominance.

On Solana, the conclusion is even clearer. Stake accounts are interchangeable; every staked SOL carries the same economic weight in the transaction flow. In this world, a multi-LST future is the default, and whoever orchestrates liquidity wins the competition.

Therefore, instead of fighting to become the single biggest stake pool, FP saw a bigger opportunity in becoming the liquidity layer that unites all LSTs on Solana.

And this was the start of Sanctum.

The way they cracked this is deeply connected to the insight. First, they created “Sanctum Router” for swaps between thousands of LSTs. A swap takes place with simply unwrapping and re-wrapping the underlying stake account.

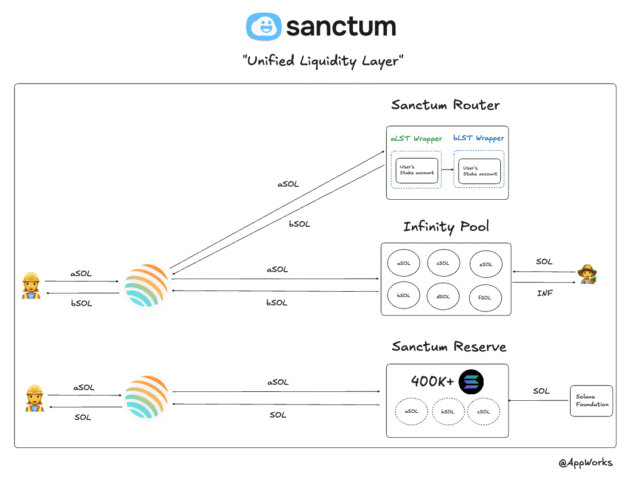

When necessary, swaps can also be routed into Infinity Pool, which can be regarded as a basket of LSTs that is managed by Sanctum, and all of these LSTs are under Sanctum’s flagship white labeled LST issuance infrastructure. When a swap is routed into Infinity, the trading fees are distributed to the liquidity providers of Infinity Pool, i.e. $INF holders.

This design reinforces liquidity for the entire Sanctum LST ecosystem while turning $INF itself into one of the most compelling LSTs on Solana.

Lastly, a sizable native $SOL reserve managed by Sanctum is shared across all Sanctum branded LSTs. For any project, instead of spinning off another multi-million liquidity pool, they can just issue their LSTs with Sanctum without worrying about bootstrapping the liquidity.

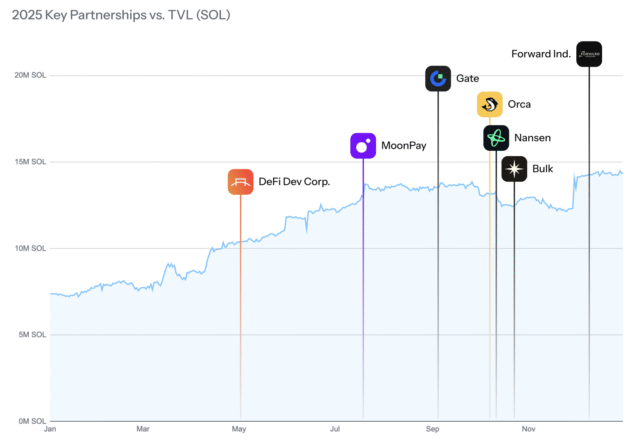

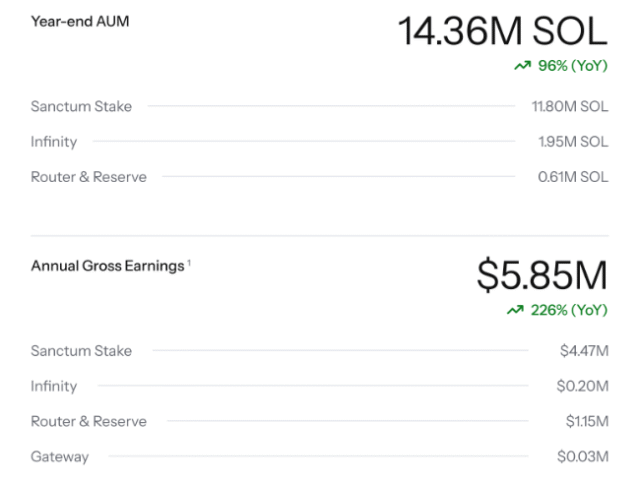

In less than 2 years, Sanctum is now managing over US$ 2B of $SOL with various key players in the space, including Bybit, Crypto.com, Backpack, Jupiter, etc. By the end of 2025, Sanctum closed the quarter with record-high metrics: 14.36M SOL (+96% YoY) under its umbrella and an annual revenue of US$5.85M (+226% YoY).

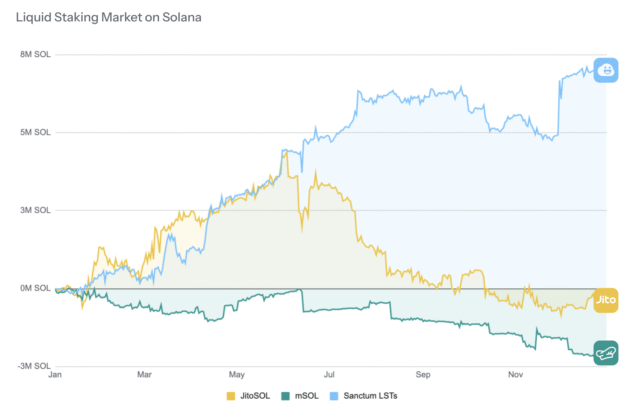

Another impressive metric to look at is Sanctum’s dominance of the Solana LST category in 2025; Sanctum achieved a net cumulative inflow of nearly 8M $SOL, while its two largest competitors, Jito and Marinade, saw their LST offerings end the year with net negative inflows. This disparity underscores the compounding competitive advantage of Sanctum’s liquidity moat within the LST market.

Looking back, it is easy to think it was all smooth and inevitable, as if Sanctum’s rise was destined. But the truth is, this was the result of five years of persistence, iteration, and unshakable conviction through market winters. Every piece of today’s success was earned the hard way, block by block, decision by decision. And that leads us to our first and foremost thesis: the founder FP.

Thesis #1: Our core beliefs in FP Lee as a founder

Practiced Contrarianism

We see in FP that he has a unique ability to see what others miss and to dive deep enough into a concept until a contrarian insight emerges.

In 2023, while many were racing to build “the Lido of Solana,” FP noticed something upstream: Solana’s stake accounts were modular and fungible by design. That single observation flipped the playbook. Instead of competing to be the biggest pool, he built Sanctum as the liquidity layer that unites every LST, and that completely changed the game.

And now, after years of living in Solana’s core, he’s spotted another inefficiency few others even noticed: the unreliable transaction layer. In short, we believe his latest move of acquiring Ironforge and launching Gateway reflects the same pattern: go deep enough, find the structural bottleneck, then build the missing piece of infrastructure that everyone else takes for granted.

Deep attachment to community

We believe founders’ ability to build a community in crypto is underrated. FP is one of the rare founders who doesn’t just “manage” a community but builds alongside them.

The Wonderland campaign, which Sanctum team held before their TGE, wasn’t just another points farm; Sanctum turned it into a coordinated, gamified quest layer where users stake LSTs to earn EXP and complete community challenges together, which kept participation sticky instead of mercenary.

The result was amazing, Sanctum’s TVL grew 171% in 38 days, and community forums spun up recurring events (like the Cloudfam Emoji Clan contests) that kept members creating and recruiting long after the initial drop, showing organic momentum rather than paid churn. Its community, later affectionately known as CloudFam, became one of the strongest grassroots movements on Solana.

What most people don’t know is how far FP and the team went to show that care. When it came time for the $CLOUD airdrop, they didn’t just run a script or crunch numbers in a spreadsheet. They manually sifted through thousands of Discord channels, Telegram chats to identify true evangelists and rewarded them far more generously than most projects would.

A token is ultimately a founder’s second product. Doing “token IR” right isn’t just about managing price; it’s about building trust, transparency, and belonging. Many founders say they care about token holders, but few actually walk the talk.

FP is one of those few that from publishing monthly updates to constantly engaging users in Discord, he treats community building like an ongoing craft. Over time, that level of authenticity compounds, turning a user base into something closer to a movement. We believe this will remain one of Sanctum’s strongest long-term differentiators.

Found his mission along the way

FP didn’t set out to be a founder. Before crypto, he was just a young software engineer trying to find his way. He stumbled into Solana out of curiosity and a desire for growth, and he stayed because, somewhere along the journey, he found meaning.

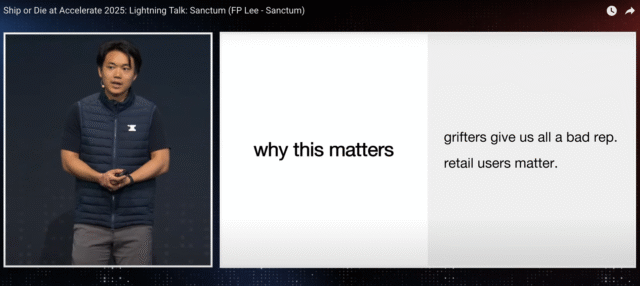

That meaning came from experience. After years of building in crypto, FP has seen it all — the FTX collapse, teams rugging their users, projects recklessly gambling away entire treasuries. In an industry often clouded by short-termism and greed, FP wants to prove that it is still possible to build a great product, stay transparent, and win the right way.

As intangible, and perhaps as cliché as it sounds, we believe this is one of the strongest forms of drive in the industry — and it is precisely the kind of mission we want to back.

Thesis #2: Major upcoming catalysts for Sanctum LST

We see several catalysts for Sanctum LSTs, and we hold a strong conviction that everything is clicking for them now.

Solana LST is still early-stage and growing

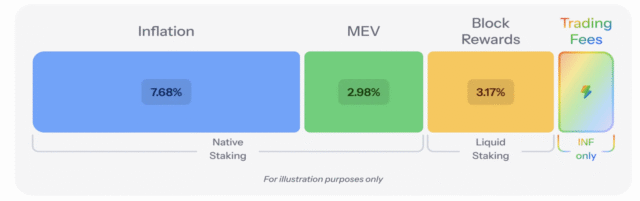

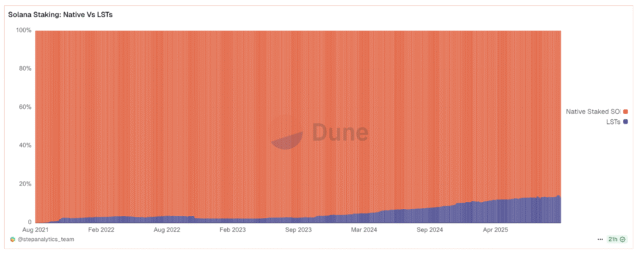

Solana’s liquid staking penetration has expanded 4.4x in two years, from 3% to 13.3%. This acceleration was actively driven by ecosystem catalysts like Sanctum and a growing appetite from validators to capture LSTfi market share.

However, this 13.3% penetration implies that most of the staked $SOL remains illiquid. Drawing a parallel with Ethereum’s more mature market (approaching 35-40% LST penetration), it’s clear Solana’s liquid staking layer, the key to unlocking capital efficiency and composability, is still in its early innings.

We believe in this context, Sanctum is positioned right at that inflection point. Sanctum’s product suite (Router, Reserve, Infinity) is explicitly designed to be this non-partisan liquidity backbone. This creates a powerful moat, positioning Sanctum as the default aggregation point for a rapidly expanding and fragmenting market.

Network effects of LSTs

For any protocols that are launching a new LST, they don’t want to spin up multi‑million‑dollar liquidity pools. Instead, the easiest way is to plug into Sanctum, and focus solely on branding, core product, and distribution; Sanctum supplies the liquidity layer (Router + Reserve + Infinity) so these LSTs are interchangeable with the rest of Solana on day one. This is what we have been seeing. The alliance has been getting stronger and stronger every day. To date, Sanctum is serving all the biggest clients like Jupiter, Bybit, Backpack.

More integrations → more supported LSTs → more interchangeable routes → deeper utility across DeFi.

That flywheel is hard to catch up to.

The Institutional Staking Layer

The competition for Solana’s yield is rapidly evolving beyond DeFi-native protocols. A new, larger wave of sophisticated capital, ranging from TradFi asset managers and potential SOL staking ETFs to publicly traded companies (like DATs), is now entering the arena.

For these entities, base staking yield is merely the starting point. To attract serious AUM, they must offer compliant, branded, and highly differentiated liquid products. This requires layering unique validator strategies, transparent reporting, and deep DeFi integrations on top of a base LST.

This is precisely where Sanctum becomes the critical enabling infrastructure. As a neutral, modular platform, it provides the full-stack “Staking-as-a-Service” for any entity to launch its own LST. It allows them to retain full control over their financial strategy and branding while outsourcing the deep technical complexity to Sanctum’s proven liquidity layer and composable backend.

We are already seeing strong validation. In May 2025, DeFi Development Corp (NASDAQ: DFDV), a publicly traded financial firm, launched dfdvSOL using Sanctum’s infrastructure. This marked the first time a listed company held and utilized a bespoke Solana LST. Their explicit goal is to contribute liquidity back to the Solana DeFi ecosystem, creating a flywheel effect that also benefits their own corporate balance sheet.

It is our core belief that as more structured SOL products emerge to compete for this new wave of capital, Sanctum will be their default launch partner and liquidity backbone.

Our thesis is clear. In the short to medium term, Sanctum is the most underrated infrastructure play for this institutional wave, and they are quietly becoming the essential plumbing every major yield-bearing Solana product will depend on.

Thesis #3: Sanctum App will become the de facto entry point for Solana

At the 2025 Solana Breakpoint, Sanctum unveiled its latest endeavor: the Sanctum App. This is a lightweight, delightful application designed to help users effortlessly grow their $SOL holdings through daily rewards in a fun, gamified environment.

This pivot stems from a first-principles approach. Referring back to our initial thesis, the primary reason Sanctum LSTs haven’t yet reached peak market penetration is the friction inherent in current DeFi UX. It is easy to forget that many $SOL holders exist entirely outside the “DeFi bubble.” They aren’t interested in the technical internals of Solana or the complex math behind LST yields; the only way to reach them is to abstract that complexity away. Following the massive success of Wonderland, we are doubling down on our belief that the Sanctum founding team is one of the few with the “DNA” to not only build a community but—more importantly—earn its lasting trust. From a team-gene perspective, we are confident they can capture lightning in a bottle once again.

From a product standpoint, the journey has come full circle. The Sanctum team were the pioneers who took the complicated concept of stake accounts and made LSTs accessible. Now, they are scaling that mission to a much wider audience. Moving forward, we expect the Sanctum App to serve as the primary interface and entry point for everyday users, while Sanctum LSTs continue to function as the foundational backbone of the entire Solana infrastructure.

Summary

When we look at Sanctum we see more than just a protocol, but the foundation of Solana’s next chapter: at its core is FP, a contrarian founder who builds with conviction and has led Sanctum from a simple idea into the liquidity fabric of Solana, and now it’s expanding even further into the transaction infrastructure. Apart from that, we also see the LST business continues to compound through strong network effects, institutional adoption, and deep integrations across the ecosystem.

Ultimately, this is why we invested. FP & Sanctum represent everything we believe in.

About AppWorks

Founded in 2009, AppWorks is a leading accelerator + VC in Asia and Web3, managing US$ 368M across its funds. At AppWorks, we invest in the founders who are obsessed with true product-market fit and committed to playing the long game. If this resonates with you, let’s chat.