Sophie Chiu, Associate (邱敬媛 / 投資經理)

Sophie is an Associate in the investment team. Before joining AppWorks in 2020, Sophie had 10 years of experience covering public equities. She was part of the portfolio management team at Neuberger Berman, focusing on emerging market opportunities. Prior to that she served as a research analyst at Credit Suisse, JPMorgan, and London-based Autonomous Research. Sophie holds a Master of Finance with distinction from Warwick Business School and BS Finance from National Taiwan University. Her passion and expertise, however, extend far beyond just researching companies and industries. She is also an author of two published poetry books and holds a keen interest in human psychology and human behavior.

Whilst founders and early investors often regard an initial public offering (IPO) as an end goal, public market investors rather see it as the company’s first debut, akin to the NBA draft. With that said, there are some key qualities that the capital market looks for in a public company. In fact, there is already a standard of what is regarded as a ‘good IPO.’ I believe by understanding this, mid-to-late stage founder-CEOs can design a more structured roadmap for going public, or even rethink whether an IPO is actually the best option for their company. This piece of article is more written for growth stage founder-CEOs. However, if you’re an early-stage founder, I believe this article can also shed some light on what is ultimately valued the most in the sometimes arcane process of filing for an IPO.

Trust is what helps companies earn long-term loves in the public market. It’s a playing field with big guys that have already proved their sustainability, building layers upon layers of trust as each quarter passes. Trust is cultivated not only through data (a result of management and operation), but also through market reaction. This means, executing a good or even strong IPO is indeed very important because the trust is then solidified from day one.

Three qualities: Growth, Size, and Momentum

From my 10 years of experience in both brokers and asset management firms, I see growth, size, and momentum the three qualities that overwhelmingly dictate the success of an IPO. Usually a banker would prepare a scorecard, rating a handful of factors that advise the parameters of a public offering. But, these three in particular have an outsized impact on a company’s debut, and understanding their underlying mechanics can help founders become more informed before they enter the negotiating room and differentiate true advice from sweet words. I will also introduce a few unfortunate case studies to help illustrate the importance of these factors.

Growth

Growth, like in any fundraising process, is the most important factor. In the public market, growth expectations are not as high as in private, early-stage startups where 100% month-over-month is the norm. However, a 3-year compound annual growth rate (CAGR) of 50-60% is still an ideal benchmark to strive towards, at least for a technology company. Consequently, timing of an IPO is a key consideration for startups; list while there are still strong growth prospects, otherwise poor market feedback is all but certain.

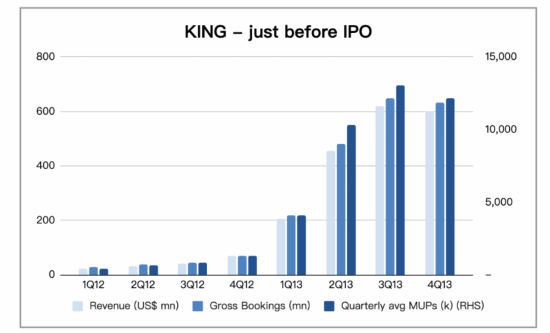

Candy Crush Saga, a staple among every grandma’s home screen, had gone through such pain. Its Irish parent company, King Digital Entertainment (delisted in 2016), first filed for an IPO in September 2013. Soon in December 2013, news about King’s consideration of delaying the IPO due to market concerns about the sustainable growth of the company had spread. Back then, Candy Crush Saga accounted for over 75% of King’s gross bookings and it has already reached 500 million downloads, topping the charts of the iTunes store. From the IPO filing, monthly unique players (MUPs) had already declined in the latest quarter by 6.5% , whilst gross bookings and revenues dropped 2-3%. This implied a negative signal for the growth expectations post IPO. The resulting impact on King’s stock price was evident, down 16% on the day of the IPO, with its valuation dropping US$ 2 billion (from US$ 7 billion) in the span of two months. Moreover, the follow-up financial reports confirmed the market’s concerns; King delivered a mere 20% in revenue growth in 2014, and subsequently declined 25% in 2015.

quarter (4th quarter in 2013) before IPO.

Size

Size is a very important factor, but often overlooked by many startup founders; although, it may matter less if the growth rate is significant, say 80-100% year over year. Size encompasses both a company’s market cap and daily trading value and collectively determines the number of investors that can potentially participate. In Asia, the most ideal professional fund size is at least US$ 1-3 billion, which means an average position would be minimum US$ 20 million. This implies two things: (1) since most funds are not allowed to own more than 10% of the company, there’s an implied minimum market cap of US$ 200 million; and (2) even if a fund is willing to trade for 60 days (three months of working days) to buy enough shares, it means the daily trading value needs to be US$ 1.6 million at least (assuming a fund would not trade more than 20% of the amount to avoid affecting the price). However, the math here represents the bare minimum case. Most investors consider US$ 500-1,000 million as the bottom threshold for market cap, with anything below yielding very little appetite.

Many startups in Asia might face issues here. In Taiwan, it is a very common experience. For example, we have Kuo Brothers (8477 Taiwan), one of the main e-commerce players that was listed at a valuation of only US$ 30 million. This already implied a potential daily liquidity lower than US$ 1 million, greatly limiting the size of the potential investor pool. I was fortunate enough to chat with the chairman of Kuo Brothers Jerry Kuo and get his thoughts on this matter: “We certainly recognise the limit from our size, which actually leads to Kuo Brothers being greatly undervalued. However, coming to the public market still has its beauty, especially in talent recruiting and business expansion, at least for Kuo Brothers at the current stage. I believe in time the market will recognise our value as we grab more shares from this highly potential market in Taiwan.”

Despite many Southeast Asian stock markets sharing similar features as Taiwan’s, founders in this region have long recognized the necessity to expand and reach a certain scale before even thinking about filing for a public offering. Sea Group’s 2017 IPO on the NYSE paved the way for Southeast Asian startups. It was the first unicorn from the region that went public at a valuation of over US$ 4 billion. Many other unicorn startups in excess of that size including Grab, Traveloka, and Gojek are now on deck.

Momentum

Momentum is the last but no less critical factor for a successful IPO. When I say momentum, I mean the market reaction in the first couple of days or months preceding a company’s first day of trading. Some may regard momentum as a function of trading or expectation management. I would define it as a reflection of a founder’s ability to deliver on their promise to the market. Momentum is generated only if a company achieves, if not exceeds its forward-looking guidance. It is about execution. If there are any technical matters to take into consideration, at most I would suggest avoiding setting your listing window during major political or economic events such as elections or Fed meetings.

I would categorize momentum into three stages. These stages all matter, but it’s better if a company builds a strong momentum throughout, or at least exhibits a gradually recovering trend.

Stage 1: The IPO day – I would recommend that a company must never underestimate IPO day. It very often sets the tone of the market reaction. It is a direct reflection of the market’s appetite or view of the IPO pricing, and future growth potential. When deciding the IPO valuation, higher doesn’t necessarily always mean better; a valuation on the high end could lead to inflated expectations and therefore a higher probability of price correction on IPO day.

Stage 2: Before the first reporting – Investors tend to build some buffer in their model. They tend to apply some, if not a major discount to the guidance outlined in a company’s IPO prospectus. That is why expectations are rather mixed and vulnerable before the first reporting. Do not do anything that leads to further doubt. Again, it is about execution. A company should deliver what it has promised, signalling that the business is on track and in good hands. Any mistake (or misfortune) at this stage could instantly break investor trust, requiring an extensive amount of time and effort to rebuild it.

Stage 3: First reporting day – A company should deliver a good set of results that are in line with the guidance provided during the IPO process. The market reaction on the first reporting day will anchor a basic view on the company. If the reaction is strong, the company would have secured a solid level of trust among investors. On the other hand, a bad reaction would take extra effort and time to rebuild the company’s positioning in investors’ minds.

Snap’s IPO in 2017 is a great example here. Although Snap’s share price surged 44% on the first day of trading, the stock price soon lost momentum. Major reasons were related to the uncertainty of the IPO valuation, which was at 62x P/S ratio vs. Twitter’s 4x and Facebook’s 13x back then. Stock price fell 50% from the peak before the first reporting in the second quarter of 2017. However, the results made the situation worse. New installs of Snap dropped 21% year over year, comparatively worse than Instagram’s 8% year-over-year increase in the same period. Revenues and user growth also undershot, eliciting deep disappointment among investors and sending the price of its stock even lower. After this, Snap hovered at a low-price range for two years until they managed a comeback in 2019.

Focus on your flywheel

Given the qualities discussed, I hope you now have a better idea of what exactly it means to be IPO-ready. My final piece of advice echoes popular sentiment among the most common early-stage pitfalls to avoid—premature scaling. Do not prematurely go into an IPO for the sole purpose of competing against the big guys. We all agree that going IPO has its merits: It offers an exit for your early investors, and lets veteran employees realise the value of their ESOP and efforts. In the meantime, the public market is indeed an effective and open place for (friendly) funding. However one should not ignore the fact that public market investors are not like the VCs and angels who spend years watching your company grow. Every inch of your ambition, vision, and execution are now under the eye of public scrutiny, where investor reactions tend to be immediate and widely irrational. So irrational, in fact, that an entirely new field of study has emerged called behavioral finance, where a handful of psychologists and economists have already been awarded Nobel Prizes. When expectations go sour, both valuation and liquidity (trading value) drain even faster. This vicious cycle can significantly impede the value and momentum of your business, taking years to build up again.

Therefore, I would highly recommend growth stage founders put a proper plan in place when considering an IPO. Make sure you have good growth, good size, and good execution and hence can deliver good initial momentum. Only then will you be in a position to reap the full benefits of the public market.

【We welcome all AI, Blockchain, NFT, or Southeast Asia founders to join AppWorks Accelerator】

Photo by Ahmad Ardity on Pixabay